Getting paid in construction shouldn’t be hard, but the pre-lien notice in Texas is your first line of defense when payments don’t come through.

- Subcontractors and suppliers must send pre-lien notices to preserve their right to file a mechanic’s lien.

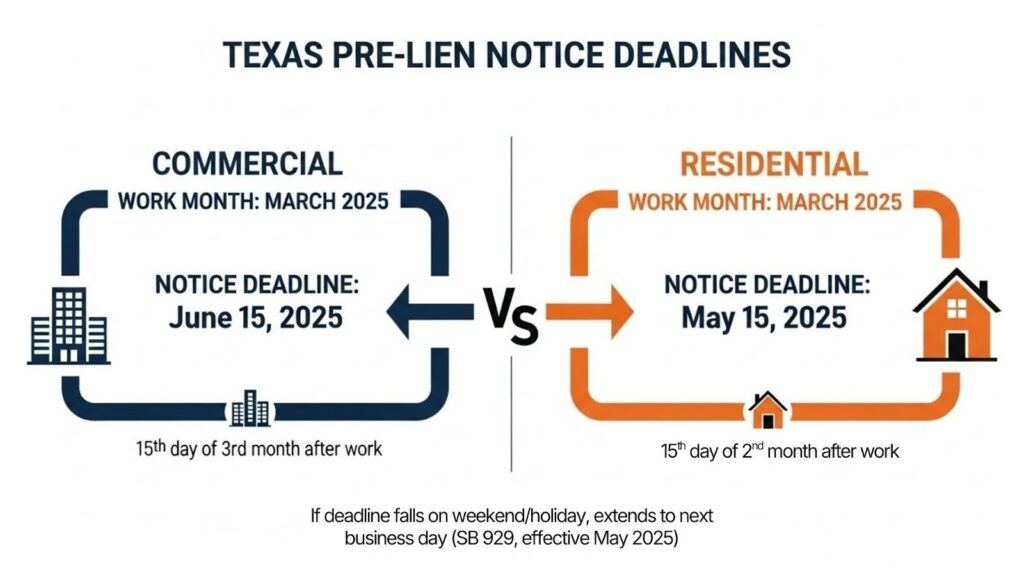

- Commercial project notices are due by the 15th day of the 3rd month after work; residential deadlines are the 15th of the 2nd month.

- You need a separate notice for each unpaid month of work.

- Missing the deadline means losing your lien rights entirely, so track your dates carefully and consider using digital tools to stay compliant.

If you’re not getting paid, start preparing your notice today because Texas deadlines don’t wait for anyone.

Payment problems are getting worse in construction, as the number of contractors experiencing payment delays of 30+ days increased from 49% to 82% over the past few years. These delays cost the industry an estimated $280 billion in 2024 alone. When invoices go unpaid, contractors need a way to protect themselves, and that starts with the pre-lien notice.

A pre-lien notice in Texas is the legal warning you send to property owners and general contractors when you haven’t been paid for your work. Think of it as a formal heads-up that says, “I’m owed money, and if this isn’t resolved, I may file a lien against this property.” Without this notice, subcontractors and suppliers lose the right to file a mechanic’s lien altogether.

Texas has some of the strictest lien laws in the country. The rules can feel complicated, but once you understand the basics, protecting your payment rights becomes much more manageable. This guide walks you through everything you need to know about sending a notice of intent to lien letter, from who needs to send one to exact deadlines and what happens if you miss them.

What Is a Pre-Lien Notice in Texas?

A pre-lien notice goes by several names in Texas. You might hear it called a preliminary notice, a fund-trapping notice, a notice of non-payment, or a notice of intent to lien letter. All these terms refer to the same document under Texas Property Code Chapter 53. The document notifies property owners and general contractors that you have provided labor or materials and haven’t received payment.

The purpose of this notice is twofold. First, it alerts the property owner to potential unpaid debts on their project. Second, it gives the owner the legal authority to withhold funds from the general contractor to pay you directly. This protection is especially important for subcontractors and suppliers who don’t have a direct relationship with the property owner.

Understanding what a pre-lien notice letter does is essential because Texas law requires this notice before you can file a mechanic’s lien. Without it, you lose your lien rights for that work, which means you lose one of the most powerful tools contractors have to collect unpaid debts.

Who Needs to Send a Pre-Lien Notice?

Not everyone working on a construction project needs to send a pre-lien notice in Texas. The requirement depends on your relationship with the property owner.

Original Contractors (General Contractors)

If you have a direct contract with the property owner, you are considered an original contractor. Original contractors do not need to send a pre-lien notice before filing a lien affidavit. Your direct relationship with the owner means they already know about your work and any payment issues. However, you still need to follow the proper lien affidavit filing deadlines when seeking payment.

Subcontractors and Sub-Subcontractors

Anyone who does not have a direct contract with the property owner must send a notice of intent to lien letter before they can file a mechanic’s lien. This includes first-tier subcontractors who work directly under the general contractor, second-tier subcontractors (sub-subs) who work under other subcontractors, and all tiers below them. The 2022 law changes simplified this process by giving all subcontractor tiers the same deadlines rather than requiring lower-tier contractors to act faster.

Material Suppliers

If you supply materials to a construction project but don’t have a direct contract with the property owner, you must send a pre-lien notice. This applies whether you’re delivering lumber to a job site, providing HVAC equipment, or supplying any other materials that become part of the construction. Equipment rental companies also fall into this category when their equipment is used to improve real property.

Understanding your contractor’s lien rights helps you determine exactly what notices and filings you need based on your specific role in the project.

When Is the Deadline to Send Your Pre-Lien Notice?

The deadline for your pre-lien notice in Texas depends on whether you’re working on a commercial or residential project. Texas law uses a monthly calculation system, meaning deadlines are based on the month you performed work, not when you sent invoices or when payment was due.

Commercial (Non-Residential) Projects

For commercial construction, you must send your notice of intent filing by the 15th day of the third month after the month you performed work or delivered materials.

Example Timeline for Commercial Work Done in March 2025:

- Work completed: March 2025

- Notice deadline: June 15, 2025

- If June 15 falls on a weekend or holiday, the deadline extends to the next business day.

Residential Projects

Residential projects have shorter deadlines. Your notice must be sent by the 15th day of the second month after you performed work.

Example Timeline for Residential Work Done in March 2025:

- Work completed: March 2025

- Notice deadline: May 15, 2025

Important: One Notice Per Unpaid Month

Here’s where many contractors make mistakes. Texas requires a separate pre-lien notice for each month you work and don’t get paid. If you completed electrical work in January, February, and March but haven’t been paid for any of it, you need three separate notices, each with its own deadline.

Tracking your work months and payment status is vital for knowing how to successfully put a lien on a property.

2025 Update: Weekend and Holiday Extensions

Good news came in May 2025 with the passage of Senate Bill 929. This law clarified that if your notice of intent filing deadline falls on a Saturday, Sunday, or legal holiday, you now have until the next business day to send your notice. Before this change, contractors faced confusion about whether they needed to file early when the 15th landed on a weekend. The new law removes that ambiguity and gives contractors a bit more flexibility.

What Information Must Your Notice Include?

The law requires specific information in your pre-lien notice in Texas. Missing required elements can make your notice invalid, so double-check every detail before sending.

Your notice must contain:

- The date you’re sending the notice

- The project description and property address

- Your name and contact information as the claimant

- A general description of the type of labor or materials you provided

- The original contractor’s name

- The party you contracted with (if different from the original contractor)

- The claim amount you’re owed

- A contact person at your company

The notice must also include specific statutory warning language informing the property owner that their property may be subject to a lien if sufficient funds aren’t withheld to cover the debt. This language is required under the Texas Property Code, and leaving it out can invalidate your notice.

You can attach supporting documents like invoices or billing statements to strengthen your claim, but the core required elements listed above are mandatory.

How to Deliver Your Pre-Lien Notice

Proper delivery is as important as proper timing. Texas law accepts several delivery methods for your notice of intent to lien letter, and you should choose one that provides proof of delivery.

Acceptable delivery methods include:

- Certified mail with return receipt requested

- Any traceable private delivery service that confirms proof of receipt (FedEx, UPS with tracking)

- Personal delivery with signed acknowledgment

The 2022 changes to Texas lien law expanded acceptable delivery methods beyond just certified mail. Now you can use any traceable delivery service that provides confirmation. However, if you choose certified mail and deposit the notice in the U.S. mail properly addressed, that alone constitutes compliance even if the recipient never picks it up.

Keep copies of everything. Your certified mail receipts, tracking confirmations, and the notices themselves should all be saved. If you ever need to prove you sent your notice on time, these records become essential evidence.

What Happens If You Miss the Pre-Lien Notice Deadline?

Missing your pre-lien notice deadlines has serious consequences. Without a timely notice, you lose the right to file a mechanic’s lien for that month’s work. Period.

No exceptions exist for contractors who didn’t know about the deadline or who were too busy to send paperwork. Texas lien laws are strict because they balance the interests of contractors, property owners, and lenders. The system depends on timely notices to function properly.

If you miss the deadline for one month but worked multiple months, you can still send notices for the other months where deadlines haven’t passed. You only lose lien rights for the specific months where you missed the notice requirement. Understanding the Texas lien laws in 2025 helps you avoid these costly mistakes.

Without lien rights, your options for collecting payment become limited to standard collection methods like lawsuits or collection agencies, both of which are more expensive and less effective than a properly filed mechanic’s lien.

Tools That Make Pre-Lien Notice Filing Easier

Managing multiple deadlines across projects gets complicated fast. One missed date can cost you thousands of dollars in lost lien rights. Technology becomes your friend.

Modern digital platforms help contractors handle their notice requirements without the confusion of paper calendars and manual tracking. The right tools calculate your exact deadlines based on when work was performed, guide you through creating compliant notices with all required information, provide traceable delivery with proof of receipt, and store your records for future reference if disputes arise.

Automated deadline reminders eliminate the risk of forgetting a date when you’re busy running jobs. Many contractors find that digital tools pay for themselves many times over by preventing even a single missed deadline.

The best platforms are designed specifically for Texas lien law, which means they understand the unique requirements of the Texas Property Code. Generic document services often miss important Texas-specific details that can invalidate your notices.

Frequently Asked Questions

Do general contractors need to send pre-lien notices in Texas?

No. Original contractors who have a direct contract with the property owner are not required to send pre-lien notices. They can proceed directly to filing a lien affidavit if payment issues arise. The notice requirement applies only to subcontractors, sub-subcontractors, and suppliers without a direct relationship with the property owner.

Can I send a pre-lien notice and file a lien on the same day?

Yes. Your notice of intent to lien letter can be sent on the same day you file your lien affidavit, as long as both are within their respective deadlines. The notice doesn’t have to be sent days or weeks before the lien, just before or simultaneously with the filing.

What if the property owner claims they never received my notice?

If you sent your notice by certified mail and have proof of mailing to the correct address, Texas law considers your notice requirement satisfied even if the recipient never picked up the mail. Keep your certified mail receipts or tracking confirmations as proof of compliance.

Do the same notice rules apply to residential and commercial projects?

The rules are similar, but the deadlines differ. Residential projects have shorter notice deadlines (15th day of the 2nd month after work) compared to commercial projects (15th day of the 3rd month after work). Always verify whether your project qualifies as residential under the strict Texas definition, which requires the owner to occupy or intend to occupy the property as their residence.

Get Your Pre-Lien Notice Filed and Protect Your Payment Rights

Sending a proper pre-lien notice in Texas is your first step toward securing payment when clients don’t pay. The process requires attention to detail and strict adherence to deadlines, but it’s absolutely manageable once you understand the rules. Track your work months carefully, know your deadlines, include all required information, and use traceable delivery methods.Don’t let unpaid invoices stack up while deadlines pass. Texas Easy Lien makes the entire process simple by helping you prepare, send, and track your pre-lien notices online in minutes. To protect your lien rights and get paid for your work, get started with Texas Easy Lien today.