Filing a mechanic’s lien in Texas protects your right to payment when clients don’t pay.

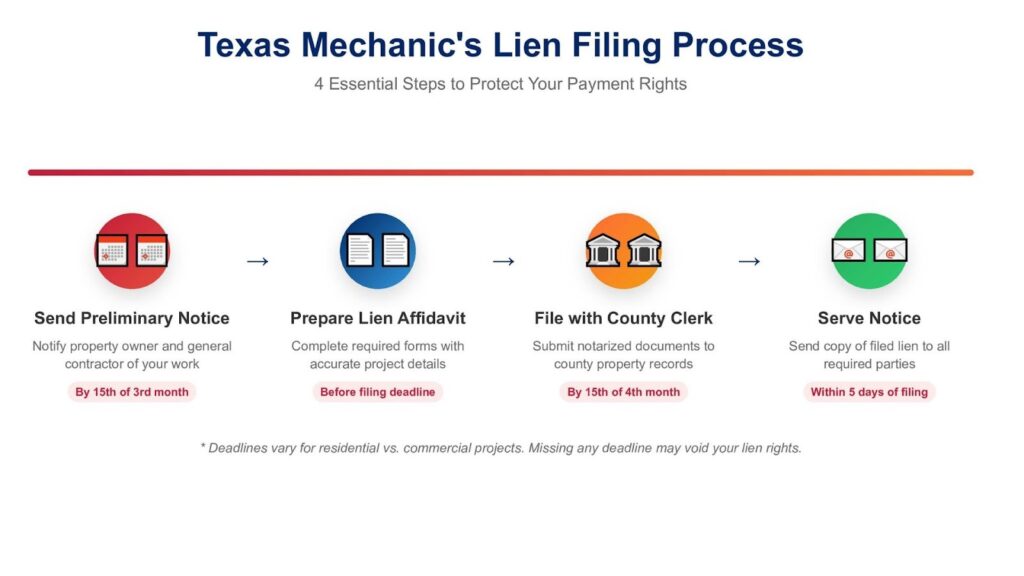

- Four main steps: Send preliminary notices, prepare lien affidavit, file with county clerk, and serve notice to property owner

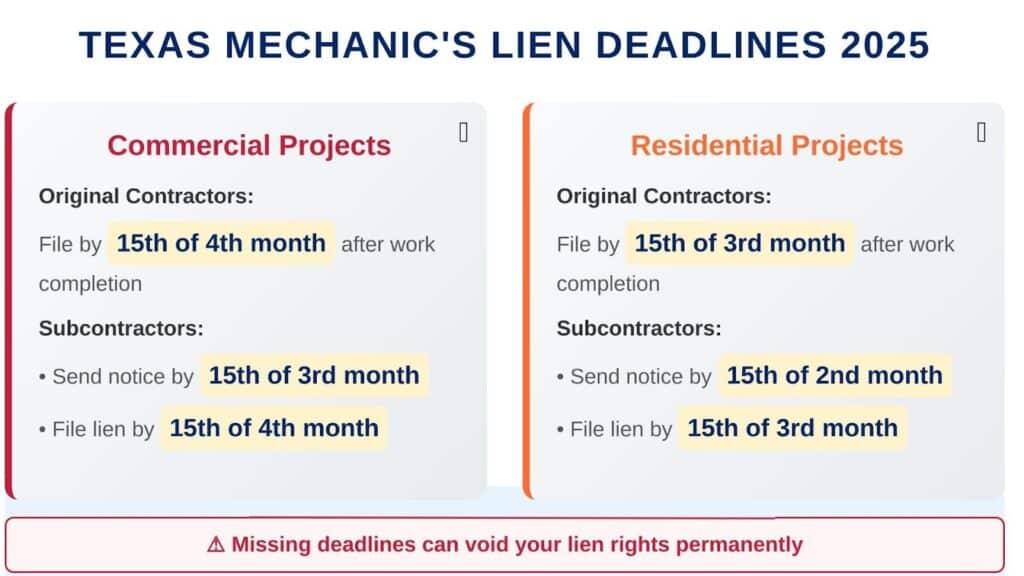

- Critical deadlines: Original contractors have 4 months (commercial) or 3 months (residential); subcontractors must send notices first

- 2025 costs: County filing fees plus notary and service costs; online services streamline the entire process

This comprehensive mechanic’s lien guide answers all your questions and walks you through each step to file a lien in Texas.

If you’re a contractor, you know that getting paid for your work can sometimes be a challenge. One of the best ways you can protect your right to get paid is by filing mechanic’s liens. But what is a mechanic’s lien, and how do you file a lien for unpaid work in Texas?

With Texas construction activity continuing to surge across the state in 2025, understanding how to file a mechanic’s lien in Texas has never been more important. The state’s construction boom means more opportunities but also more potential payment disputes.

Despite the name, this lien is not for auto mechanics. The Republic of Texas created the mechanic’s lien law in 1839 to help people in the construction business get paid. Back then, workers were protected if they filed a written contract within 30 days. Now it’s more complicated to understand the details of the Texas lien process, so here are answers to some commonly asked questions.

What Is A Mechanic’s Lien?

A mechanic’s lien is a legal claim on real property in exchange for unpaid labor, services, supplies, or materials furnished to improve that specific property. Mechanic’s liens are a type of construction lien that helps secure payment for labor or materials provided. When properly filed, the mechanic’s lien shows up as a debt on the property’s title and motivates its owner to get you paid. A legal tool that helps contractors, subcontractors, and suppliers recover payment for:

- Labor and professional services

- Equipment and construction materials

- Specially fabricated materials

There are different requirements depending on whether a job is commercial, residential, or a public project.

Who Can File A Mechanic’s Lien?

A wide range of professionals in the construction industry can file a mechanic’s lien when they haven’t received payment for their work or materials. This includes general contractors, subcontractors, material suppliers, and laborers. Specific trades such as plumbers, electricians, HVAC installers, and other service providers on construction projects are also eligible.

Texas Property Code extends this right to design professionals as well, including architects, engineers, and surveyors. If your business supplies construction materials, including supplies, machinery, fixtures, or tools used in the project, you’re likely eligible to file a lien. This also covers the cost of construction equipment rentals used or delivered to the construction site.

Before filing a mechanic’s lien, many states require contractors to send a preliminary notice to secure their lien rights. Mechanic’s liens are primarily available for private construction projects, including residential property, commercial property, and industrial construction.

For public property projects, where mechanic’s liens aren’t applicable, contractors and suppliers have a different recourse. They can file a bond claim against the payment bond that state law requires for public projects. This serves a similar purpose to a mechanic’s lien, helping to ensure payment for work on public construction projects.

While the ability to file a lien is broad, the Texas lien process and requirements can be complex. To successfully secure your right to payment, it’s vital to understand and follow the specific rules and deadlines that apply to your situation.

Why File a Mechanic’s Lien?

Filing a mechanic’s lien is an essential step for contractors, suppliers, and laborers to secure payment for their work or materials provided on a construction project. By filing a lien, these parties can protect their interests and ensure they receive payment for their services. A mechanic’s lien provides a security interest in the property, making it difficult for the property owner to sell or transfer the property until the lien is resolved.

Filing a mechanic’s lien can also help to prevent project delays and cost overruns, ensure timely payment for work completed or materials provided, protect against non-payment by property owners or contractors, provide a clear and formal record of the debt owed, and increase the chances of getting paid through the threat of foreclosure.

In addition, filing a mechanic’s lien can also help to establish a paper trail, which can be useful in case of a dispute or lawsuit. By filing a lien, contractors and suppliers can demonstrate that they have taken all necessary steps to secure payment and can provide evidence of their efforts to collect the debt.

What Is The Difference Between Residential And Commercial Construction Projects?

Residential and commercial construction projects differ in several key aspects, each with unique requirements and regulations.

What is residential construction? This construction type typically involves building, remodeling, or repairing structures intended for individual or family living. This includes single-family homes, duplexes, triplexes, and quadruplexes. Residential projects often have more personal involvement from the property owner and are subject to specific laws designed to protect homeowners.

Commercial construction, on the other hand, encompasses a broader range of structures used for business purposes. This includes office buildings, retail stores, hotels, factories, and multi-family housing complexes larger than fourplexes. Commercial projects tend to be larger in scale, more complex, and involve more stakeholders.

The legal requirements for these two types of construction also differ. For residential projects in Texas, contractors must provide specific notices to the property owner before starting work and have a written contract if the property is the owner’s homestead. Commercial projects typically have more relaxed notice requirements but may involve more complex contracts and permitting processes.

When it comes to filing mechanic’s liens, the deadlines and procedures vary between residential and commercial projects. For residential construction, lien filing deadlines are generally shorter, and the process can be more stringent. Commercial projects often allow for longer filing periods but may involve more complex lien hierarchies due to the number of parties involved.

Understanding these differences affects everything from project planning and execution to legal compliance and payment security. Whether you’re working on a family home or a large commercial development, being aware of the specific requirements for each type of construction can help ensure a smooth project completion and protect your right to payment.

What Are The Requirements For A Mechanic’s Lien In Texas?

Filing a mechanic’s lien in Texas has specific steps and requirements. The Texas lien process is designed to protect both the rights of contractors and property owners, ensuring fairness and transparency.

Failing to meet any of these criteria could result in an invalid or unenforceable lien. Let’s break down the key requirements you must meet to successfully file a mechanic’s lien in Texas:

Eligibility: You must be a contractor, subcontractor, or material supplier who has provided labor or materials for the improvement of real property.

Timely Notice: You must provide timely notice to the property owner and general contractor (if you’re a subcontractor) of your intent to file a lien.

Proper Documentation: You must complete and file a lien affidavit with the county clerk in the county where the property is located. The lien form must be accurately completed with all required details about the property and the debt owed.

Deadlines: You must file the lien within specific deadlines, which vary depending on your role in the project and the type of project.

Correct Information: The lien must contain accurate information about the property, the amount owed, and the work performed.

Proper Service: After filing, you must serve a copy of the lien to the property owner and general contractor within specific timeframes.

What Is A Preliminary Notice?

A pre-lien notice is a formal document sent to inform property owners and general contractors that a subcontractor or supplier is working on their project and may file a lien if not paid. This notice is a vital step in protecting your right to file a mechanic’s lien in Texas.

For commercial projects, subcontractors and suppliers must send this notice by the 15th day of the third month following each month in which they provided labor or materials. For residential projects, the deadline is the 15th day of the second month. General contractors typically don’t need to send these notices.

The pre-lien notice serves several important purposes. It establishes your presence on the project, making the owner aware of potential lien claimants. It preserves your right to file a lien if payment issues arise later. It often prompts payment without the need for actually filing a lien. It fulfills a legal requirement necessary for a valid lien claim in Texas.

Failing to send a pre-lien notice on time can result in losing your lien rights, so track your deadlines carefully. Many contractors use specialized services to ensure these notices are prepared correctly and sent on time, safeguarding their right to payment throughout the project.

While sending a pre-lien notice is an essential step, it doesn’t automatically create a lien. It simply preserves your right to file one if necessary. For situations where you need to take more formal action, you might also consider preparing a notice of intent to file lien, which can often resolve payment disputes before filing an actual lien.

What Is A Lien Affidavit?

A lien affidavit is a formal, sworn statement that serves as the cornerstone of the mechanic’s lien process. This document, which must be signed under oath, details the nature of the work performed, the amount owed, and other crucial information about the claim. It’s not just a simple form, but a legally binding declaration that carries significant weight in court proceedings.

A judgment lien is another type of security interest in property that can sometimes conflict with mechanic’s liens.

The affidavit is the actual document you fill out, sign, and have notarized, serving as the official record that asserts a lien against a property. Once the lien affidavit is recorded with the County Clerk where the job is located, it transforms from a mere document into a legal record, known as a property lien. This recording process provides public notice of your claim and establishes your position in the priority of potential creditors. The information in the affidavit must be accurate and complete, as any errors or omissions could potentially invalidate your lien claim.

How Do You Find A Legal Description Of A Property?

A legal description is a precise way to identify a property for legal purposes, distinct from its street address. This detailed description is crucial when filing a mechanic’s lien. Here’s how to locate and verify legal description information:

Property Deed: The most accurate source for a legal description is the property deed. However, accessing this document may not always be feasible.

County Appraisal District: Each county’s appraisal district maintains a database of property records. To access this, search online for “[County Name] Texas appraisal district records,” navigate to the Property Search function on the website, enter the property details to locate the record. For example, for a project in Austin, search for “Travis County Texas appraisal district records.”

Verification: Once you’ve found the property record, compare the information with any documents you have, ensure the legal description and owner’s name match the property deed, and if discrepancies exist, prioritize the information from the property deed.

Alternatives: If you’re having difficulty finding or verifying the legal description, some lien filing services assist with verifying legal descriptions. While a legal description is preferred, using the property’s street address in your lien document will not invalidate your lien.

Accuracy is key when filing a lien. Taking the time to find and verify the correct legal description can prevent potential issues later in the process. If you’re unsure about any information, consider seeking assistance from a professional service.

How Much Does A Mechanic’s Lien Cost In Texas?

The cost of filing a mechanic’s lien in Texas can vary depending on several factors, and it’s important to consider all potential expenses when deciding to pursue this legal action. While the process is designed to help contractors and suppliers secure payment for their work, there are associated costs that can add up.

These costs can range from minimal filing fees to more substantial amounts if professional assistance is required. To help you budget for filing a mechanic’s lien, let’s break down the potential costs you might encounter:

County Filing Fees: County filing fees vary by location. When combined with notarization, service fees, and any professional assistance, total costs can vary significantly depending on your chosen approach and county requirements.

Additional Pages: If your lien document is more than one page, there may be additional fees per page.

Service Fees: You may incur costs for serving the lien notice to the property owner and general contractor.

Professional Legal Assistance: If you use a lien filing service or an attorney, there will be additional fees for their services.

Notary Fees: The lien affidavit must be notarized, which may incur a small fee.

Overall, the total cost can range from about $25 to several hundred dollars, depending on these factors and your chosen method of filing.

2025 Updates: Electronic Filing and Streamlined Processes

The filing process has become more streamlined in 2025. Many counties now accept electronic filing, which can reduce both time and costs. For example, Dallas County charges $25 for the first page and $4 per page for additional pages when filing in person.

Electronic filing services have standardized many of these costs and can often complete the entire process in hours rather than days. This is particularly important given Texas’s continued construction growth, with new residential construction permits up 4% year-to-date through Q2 2025.

Steps to File a Lien: 2025 Process

Here’s the step-by-step process for how to file a mechanic’s lien in Texas in 2025:

Step 1: Determine Eligibility and Project Type: Verify that you have the right to file a lien based on your role in the project and the type of work performed. Commercial and residential projects have different requirements and deadlines.

Step 2: Send Required Preliminary Notices (If Applicable): For subcontractors and suppliers, provide any necessary pre-lien notices to the property owner and general contractor within the required timeframes. For example, if you completed work in January 2025, your preliminary notice deadline would be April 15, 2025.

Step 3: Prepare the Lien Affidavit: Complete the lien affidavit form with all required information about the property, the amount owed, and the work performed. This includes an accurate property description, contractor information, and detailed work descriptions.

Step 4: Have the Affidavit Notarized: Sign the affidavit in front of a notary public. Online notary services are now widely available and can complete this step in minutes.

Step 5: File with County Clerk: File the notarized affidavit with the county clerk’s office in the county where the property is located. Electronic filing is available in most major Texas counties in 2025.

Step 6: Serve Notice of Filed Lien: After filing, serve a copy of the filed lien to the property owner and general contractor within five days of filing.

Step 7: Track Enforcement Deadlines Keep track of deadlines for enforcing the lien if payment is not received. You have one year from the filing deadline to pursue foreclosure.

2025 Deadline Examples

After following the steps to file a lien, understanding deadlines becomes clearer with current examples. If an electrical subcontractor completed work on a commercial office building in March 2025, their timeline would be:

- Invoice Deadline: May 15, 2025 (15th day of second month)

- Pre-lien Notice: June 15, 2025 (15th day of third month)

- Lien Affidavit Filing: July 15, 2025 (15th day of fourth month)

- Post-filing Notice: July 20, 2025 (within 5 days of filing)

For a residential project completed in January 2025, the deadlines would be shorter, with the lien affidavit due by April 15, 2025.

Common Filing Mistakes to Avoid in 2025

Based on recent case law and industry experience, here are the most common mistakes that can invalidate your lien:

Missing Critical Deadlines: With Texas’s booming construction market, it’s easy to lose track of multiple project timelines. Use a calendar system or professional service to track all deadlines.

Incorrect Property Information: Even minor errors in property descriptions can invalidate your lien. Always verify information through county records.

Inadequate Notice Content: Pre-lien notices must contain specific language required by the Texas Property Code. Generic notices may not preserve your lien rights.

Filing in the Wrong County: The lien must be filed in the county where the property is located, not where your business is based.

Incomplete Work Descriptions: Vague descriptions like “construction services” may not meet legal requirements. Be specific about the work performed.

What Makes A Mechanic’s Lien Invalid In Texas?

While mechanic’s liens are powerful tools for securing payment, they must be filed correctly to be enforceable. In Texas, there are several factors that can render a mechanic’s lien invalid, potentially leaving the filer without this important legal protection.

An invalid lien not only fails to secure payment but can also expose the filer to legal consequences. Here are the key factors that can invalidate a mechanic’s lien in Texas:

Missed Deadlines: Failing to file the lien or send required notices within the specified timeframes.

Incorrect Information: Including inaccurate details about the property, amount owed, or work performed.

Lack of Proper Notice: Not providing required notices to the property owner or general contractor.

Improper Filing: Not filing the lien with the correct county clerk or not following proper filing procedures.

Lack of Eligibility: Filing a lien when you’re not legally entitled to do so (e.g., for work not actually performed).

Statutory Non-Compliance: Not adhering to all requirements set forth in the Texas Property Code.

Fraudulent Claims: Making false statements in the lien affidavit.

Waiver of Lien Rights: If you’ve previously signed a valid waiver of your lien rights.

Be sure to follow all legal requirements carefully to ensure your lien is valid and enforceable.

What Is A Lien Release, And When Do You Issue One?

A lien release removes a mechanic’s lien from a property once payment has been received. It’s the final step in the lien process, designed to clear the property’s title and officially acknowledge that the debt has been satisfied. In Texas, this release is not just a courtesy but a legal requirement.

Once you’ve filed a mechanic’s lien and received payment, you’re obligated to file a lien release in the same county where the original lien was recorded. The Texas Property Code mandates that the lien claimant must provide a signed and notarized lien release within ten days of receiving a written request from the property owner, provided the debt has been fully paid or settled.

Filing a lien release requires careful attention to detail to ensure it’s legally valid. The release form must be completed accurately, signed, notarized, and filed with the county clerk’s office. It’s crucial to use the correct form and follow all filing procedures to effectively remove the lien from the property records. If you need assistance with this process, services can guide you through the steps of preparing and filing a proper lien release, ensuring you meet all legal requirements and deadlines.

What Happens If I Don’t Get Paid?

If you do not get paid, the law allows you to foreclose on the lien (file a lawsuit). A lien must be foreclosed no later than one year from the last day the lien could have been filed in the county. This process, though, will require the involvement of an attorney.

If the court rules in your favor, you may be awarded a judgment. The judgment would let you pursue other collection resources to recover your money, such as garnishment, bank levies, or repossession of property, for example.

Do You Need An Attorney To File A Lien?

In most cases, you don’t need to hire an attorney to file a mechanic’s lien in Texas. While the state’s lien laws can be complex, with the right resources and guidance, you can successfully navigate the process yourself. Many contractors and suppliers file liens without legal representation, saving significant costs in the process.

The key to filing a lien without an attorney is having access to accurate, up-to-date information and user-friendly tools. Fortunately, there are online services available that specialize in guiding you through the lien filing process step-by-step. These platforms often provide document preparation, deadline tracking, and electronic filing options, making the process much more manageable.

By utilizing these specialized services, you can ensure that your lien documents are prepared correctly, meet all legal requirements, and are filed on time. They often offer support to answer questions and clarify any confusing aspects of the process. This approach combines the cost-effectiveness of doing it yourself with the peace of mind that comes from expert guidance.

However, for extremely complex cases or if you anticipate legal challenges, consulting with an attorney might be beneficial. But for the majority of straightforward lien filings, you can confidently handle the process yourself with the right online tools and support.

Mechanic’s Lien Enforcement: What Happens After Filing?

After filing a mechanic’s lien, the next step is to enforce the lien and collect payment from the property owner. The process of enforcing a mechanic’s lien can vary depending on the state and local laws, but generally, it involves the following steps:

Serving the Lien: The lien must be served on the property owner, either by certified mail or in person, to notify them of the lien.

Waiting Period: There is usually a waiting period, which can range from a few weeks to several months, during which the property owner can pay the debt or dispute the lien.

Foreclosure: If the property owner fails to pay the debt or dispute the lien, the contractor or supplier can file a lawsuit to foreclose on the property.

Judgment: If the court rules in favor of the contractor or supplier, a judgment will be entered, and the property will be sold to satisfy the debt.

The process of enforcing a mechanic’s lien can be complex and time-consuming, and it’s recommended that contractors and suppliers seek the advice of a construction attorney to ensure they are following the correct procedures.

Property Owner’s Perspective: Understanding the Impact of a Mechanic’s Lien

From a property owner’s perspective, receiving a mechanic’s lien can be a stressful and overwhelming experience. A mechanic’s lien can cloud the title of the property, making it difficult to sell or transfer the property until the lien is resolved, delay the completion of the construction project, as the contractor or supplier may refuse to continue working until the debt is paid, increase the costs of the project, as the property owner may need to hire an attorney to dispute the lien or negotiate a settlement, and damage the property owner’s credit score, as it can be reported to credit bureaus.

To avoid these consequences, property owners should communicate regularly with contractors and suppliers to ensure that all parties are aware of the payment terms and any issues that may arise, pay debts promptly to avoid the need for a mechanic’s lien, and review contracts carefully to ensure that they understand the payment terms and any potential risks.

By taking these steps, property owners can minimize the risk of a mechanic’s lien and ensure a smoother construction project.

Can I File My Lien Documents Online?

Yes, you can choose to prepare your lien documents online with modern filing services. Answer a few questions related to the project, review, approve, and pay. Then notarize and file, all online. There are many steps involved in filing and releasing a mechanic’s lien, which is why specialized online lien-filing services have become invaluable.

These online platforms provide a mechanic’s lien guide, making it accessible to contractors of all sizes. The easy-to-understand process walks you through each step with 2025 compliance built in. With electronic notarization available 24/7 and electronic filing capabilities in most Texas counties, you can complete the entire process from your job site or office.

Frequently Asked Questions

How long do I have to file a mechanic’s lien in Texas? For commercial projects, original contractors have until the 15th day of the fourth month after completion. Subcontractors must send preliminary notices first, then file by the same deadline. Residential projects have shorter deadlines: the 15th day of the third month for original contractors.

What information do I need to file a lien? You’ll need the property owner’s name and address, project location, amount owed, description of work performed, and if you’re a subcontractor, the general contractor’s information. Having the legal property description is helpful but not required.

Can I file a lien if I don’t have a written contract? For most projects, yes. However, work on homestead properties requires a written contract signed before work begins. The contract must be signed by both spouses if the owner is married.

What counties accept electronic filing in Texas? Many counties now offer electronic filing options, though availability varies by location. You should check with your specific county clerk’s office to confirm their current filing methods and requirements.

Protect Your Right to Payment

Filing a mechanic’s lien in Texas doesn’t have to be complicated or expensive. With the right guidance and tools, you can protect your payment rights efficiently and affordably. If you have more questions about the filing process, check out our comprehensive FAQ section for detailed answers to common concerns.

Texas Easy Lien makes the entire process simple and affordable, guiding you through each step with expert support. Contact us to learn how we can help you file your mechanic’s lien quickly and correctly.