A lien release removes a previously filed lien from a property after you’ve been paid. Here’s what you need to know:

- A mechanic’s lien release form is required by Texas law once payment is received and a written request is made.

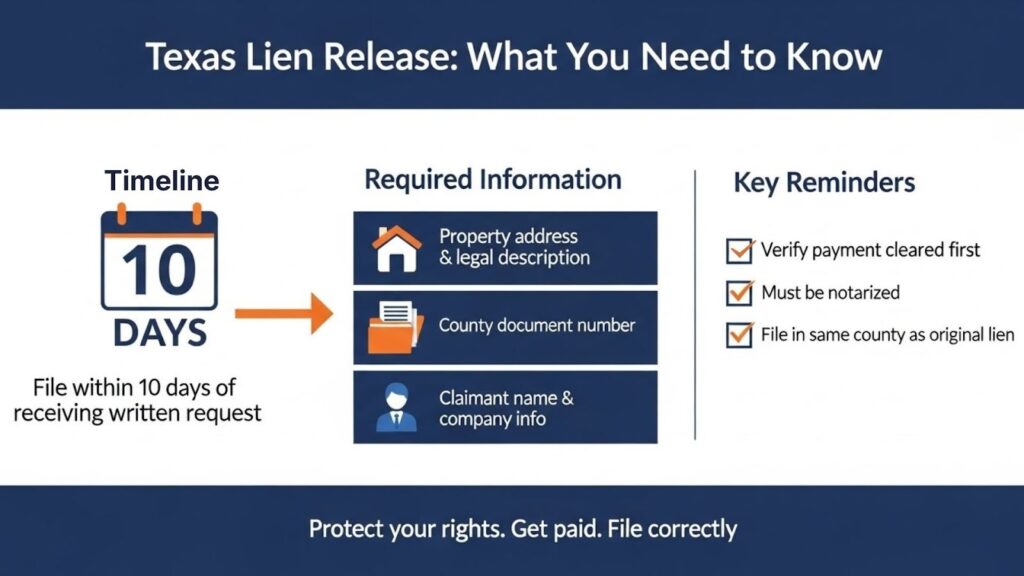

- You have 10 days after receiving a written request to file the release with the county.

- The release only removes your lien claim; it does not give up your right to pursue other legal action if you’re owed additional money.

Always verify payment has cleared before signing the release to protect yourself.

You’ve probably already filed a mechanic’s lien against a property because your invoices weren’t getting paid. The good news? Texas construction law protects contractors, subcontractors, and suppliers against non-payment. Filing a mechanic’s lien is one of the most effective tools available to collect what you’re owed. Slow payments cost the U.S. construction industry $280 billion in a single year, with 82% of contractors waiting more than 30 days to receive payment.

So, now you’ve been paid for that lien affidavit you filed. What’s next? The answer is a mechanic’s lien release form. This document removes the lien from the property and clears the title so the owner can move forward with selling, refinancing, or otherwise using their property without a “cloud” on the title.

Let’s break down everything you need to know about the mechanic’s lien release form, when to use it, and how to file it correctly in Texas.

What Is a Mechanic’s Lien Release Form?

A mechanic’s lien release form is a legal document that removes a previously filed mechanic’s lien from a property’s title. When you file a mechanic’s lien, it creates what’s called a “cloud” on the property. This cloud makes it difficult or impossible for the property owner to sell or refinance until the lien is resolved.

Once you receive payment for your lien claim, the lien release form officially cancels that lien. It tells the county records office that the debt has been satisfied and the property is clear of your claim.

Here’s an important point that many contractors miss: the mechanic’s lien release form only releases your lien. It does not release your rights to file a lawsuit if you’re still owed money beyond what was captured in your original lien affidavit. So if the property owner owes you for additional work or materials that weren’t part of your lien claim, you still have legal options to pursue that money.

The contractor, subcontractor, or supplier who filed the original lien is required by law to release their claim once payment has been issued and received. Typically, the party that paid will request the release at the time of payment.

What Is the Difference Between a Lien Waiver and a Lien Release in Texas?

This is one of the most common questions contractors ask, and it’s easy to see why. The terms sound similar, but they serve very different purposes in the construction payment process. Understanding the difference can save you from making a costly mistake.

A lien waiver is signed before a lien is ever filed. It’s essentially a receipt that says you’ve been paid and agree not to file a lien for that specific amount. Lien waivers are commonly exchanged during the payment process. Property owners and general contractors often request them before releasing payment to make sure they won’t face a lien claim later for money they’ve already paid.

A lien release, on the other hand, comes into play only after you’ve already filed a mechanic’s lien against the property. The release cancels that existing lien once the debt is paid. Think of it this way: a lien waiver prevents a lien from being filed, while a lien release removes a lien that’s already on record.

There’s another key difference in how these documents are handled. Lien waivers in Texas must follow specific statutory forms outlined in Texas Property Code Section 53.284. There are four types: conditional and unconditional waivers for both progress payments and final payments. The waiver doesn’t need to be filed with the county since it’s an internal document between parties.

A lien release form, however, must be notarized and filed with the county property records office. This filing officially clears the lien from public record. Without this step, the lien remains on the property even if you’ve been paid.

When Do You Need to File a Mechanic’s Lien Release Form in Texas?

Texas law is clear about when you’re required to file a lien release. You must file the release no later than 10 days after receiving a written request for the release, assuming you’ve been paid in full for the lien amount.

The clock doesn’t start ticking the moment you receive payment. It starts when you receive the written request to release the lien. This distinction matters because it gives you time to ensure the payment has actually cleared your bank before you sign anything.

Here are the circumstances that trigger the need for a mechanic’s lien release form:

- The payment dispute has been resolved and settled. Both parties agree that the debt is satisfied.

- Payment has been issued and received for the claim. If you’ve only received partial payment, you may need to file a partial release while maintaining the lien for the remaining balance.

- A written request for the lien release has been received from the property owner, contractor, or party that made the payment.

If all three conditions are met, it’s time to file your lien release form. Failing to do so within the required timeframe can result in legal complications. Property owners may have grounds to sue if you don’t release a lien promptly after payment, which could result in damages and legal fees you’ll have to cover.

How to File a Mechanic’s Lien Release Form: Step-by-Step

Filing a lien release in Texas doesn’t have to be complicated. Here’s what you need to do:

- Verify payment has cleared. Before you sign anything, make sure the check or payment has actually been deposited and cleared your bank. Signing a release before payment clears could leave you without the money and without your lien rights.

- Gather the required information. You’ll need the property address and legal description, the name and company information of the entity that filed the original lien, and the county document number assigned to your original mechanic’s lien when it was recorded.

- Complete the lien release form. Texas does not have a state-mandated construction lien form for releases, but the document must include specific information to be valid. Using a professional form ensures you don’t miss anything important.

- Have the form notarized. The mechanic’s lien release form must be signed and notarized by the same person who filed the original lien.

- File with the county property records office. The release must be filed in the same county where the original lien was recorded. Either you or the property owner can handle this filing, as long as the document is properly signed and notarized.

- Keep copies for your records. Always maintain copies of all lien-related documents, including your release, for future reference.

What Information Is Required on a Construction Lien Form in Texas?

When preparing your lien release form, accuracy is essential. Missing or incorrect information can delay the filing or create problems down the road. Here’s what you need to include:

The property address must match the address listed on your original lien affidavit. If you used a legal property description in the original lien, include that as well. The county document number is the reference number assigned by the county clerk when your original mechanic’s lien was recorded. This number connects the release to the original lien in the public records. Your business name and information should match exactly what appeared on the original lien affidavit. Any discrepancies could cause the county to reject the filing.

Though not always required, it’s good practice to include a statement confirming that payment has been received and the lien claim is satisfied. This step provides additional clarity in the public record.

Common Mistakes to Avoid When Filing a Lien Release in Texas

Even experienced contractors sometimes make errors with lien releases. Here are the most common mistakes and how to avoid them:

Signing before payment clears. This is the biggest mistake you can make. Once you sign a lien release, your lien rights are gone. If the payment bounces or gets reversed, you’ve lost your leverage. Always wait until funds are verified in your account.

Missing the 10-day deadline. After you receive a written request for the release, you have 10 days to file. Mark your calendar and don’t let this slip. Penalties for failing to release on time can include legal action from the property owner.

Using the wrong document number. Double-check that you’re referencing the correct county document number from your original lien. An incorrect number could mean your release doesn’t properly clear the lien.

Confusing a lien release with a lien waiver. As we discussed earlier, these are different documents for different situations. If you haven’t filed a lien yet, you need a waiver. If you have filed a lien and been paid, you need a release.

Not getting the release notarized. Unlike lien waivers, lien releases still require notarization in Texas. If you skip this step, your release won’t be valid.

Frequently Asked Questions

Is a lien release the same as a lien waiver?

No. A lien waiver is signed before a lien is filed and prevents future lien claims for payments received. A lien release removes an existing lien that has already been recorded with the county. If you filed a mechanic’s lien and have now been paid, you need a lien release, not a waiver.

Who can file the lien release with the county?

Either the claimant (the contractor or supplier who filed the original lien) or the property owner can file the release with the county property records office. However, the release must be signed and notarized by the same person or entity that filed the original mechanic’s lien.

What happens if I don’t file a lien release after being paid?

Failing to file a lien release within 10 days of receiving a written request can result in legal consequences. The property owner may sue for damages and legal fees. The lien will also remain on the property title, creating ongoing problems for the owner and potentially damaging your professional reputation.

Can I file a partial lien release if I only received partial payment?

Yes. If you receive partial payment for your claim, you can file a partial lien release that acknowledges the amount paid while maintaining your lien rights for the remaining balance. This shows good faith and keeps the property records accurate while protecting your right to collect the rest of what you’re owed.

Get Your Mechanic’s Lien Release Form Filed Quickly and Correctly

The lien release process might seem like one more piece of paperwork, but it’s an important final step in protecting your business relationships and staying compliant with Texas law. Once you’ve been paid for your claim, filing the release promptly shows professionalism and can lead to positive referrals and repeat business.

When you need to file a pre-lien notice or work through any part of the mechanic’s lien process, Texas Easy Lien makes it simple. Our platform was designed by Texas construction attorneys and provides all the documents you need to protect your payment rights. From lien affidavits to releases, we handle the complicated stuff so you can focus on your work. Contact Texas Easy Lien today to file your lien release quickly and affordably.