Key Takeaways

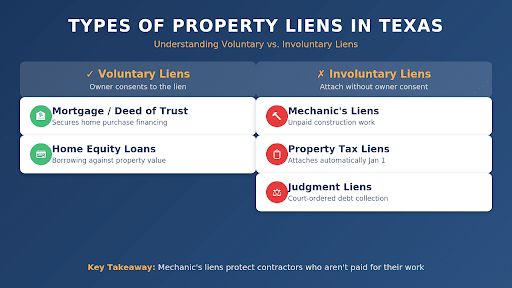

Texas recognizes multiple lien types that can affect property ownership and construction payments.

- Mechanic’s liens protect contractors, subcontractors, and suppliers who aren’t paid for construction work

- Property tax liens attach automatically on January 1 each year and take priority over most other liens

- Voluntary liens (like mortgages) require consent, while involuntary liens (like judgment liens) do not

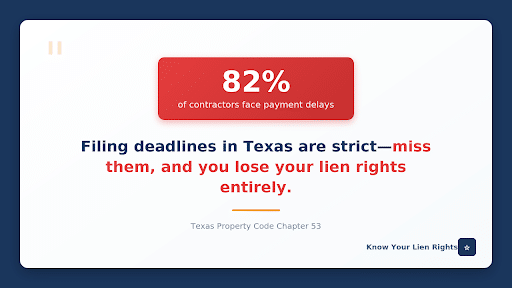

- Filing deadlines in Texas are strict—miss them, and you lose your lien rights entirely.

Property liens represent one of the most powerful legal tools available to creditors in Texas. Whether you’re a contractor chasing unpaid invoices, a property owner trying to sell your home, or a supplier wondering how to secure payment, understanding the types of property liens in Texas can mean the difference between getting paid and walking away empty-handed.

Texas construction spending reached over $50 billion in 2025, making it the nation’s leader in building activity. With that volume comes payment disputes—research shows 82% of contractors experience payment delays of 30 days or more. Knowing your lien rights isn’t optional; it’s essential for survival in this industry.

What Are the Main Types of Property Liens in Texas?

Texas law recognizes several categories of liens, each with different rules, priorities, and enforcement procedures. These liens generally fall into two broad categories: voluntary and involuntary.

Voluntary liens are those the property owner agrees to, typically as part of a financing arrangement. The most common example is a mortgage or deed of trust. You sign documents, the lender provides funds, and the lien secures repayment. If you default, the lender can foreclose.

Involuntary liens attach to property without the owner’s consent, usually as a result of unpaid debts or legal judgments. These include tax liens, judgment liens, and mechanic’s liens. Property owners often don’t realize these liens exist until they try to sell or refinance.

Mechanic’s Liens

Mechanic’s liens (also called construction liens or materialman’s liens) protect anyone who provides labor or materials for property improvements. According to the Texas Real Estate Research Center, these liens have constitutional origins in Texas, reflecting the state’s long-standing commitment to protecting those who improve real property.

Under Chapter 53 of the Texas Property Code, original contractors, subcontractors, sub-subcontractors, and material suppliers all have potential lien rights. However, the requirements differ based on your role in the project and whether it’s residential or commercial construction.

Original contractors working directly with property owners have the simplest path—they can file a lien affidavit without sending preliminary notices. Subcontractors and suppliers face additional requirements, including mandatory pre-lien notices sent to property owners and general contractors before filing becomes possible.

Property Tax Liens

Property tax liens in Texas attach automatically on January 1 of each year. Unlike other lien types, you don’t need to file anything—the lien exists by operation of law. These liens take priority over virtually all other claims against the property, including mortgages recorded years earlier.

If property taxes go unpaid, taxing authorities can pursue foreclosure. Texas allows tax lien sales, where investors purchase the delinquent tax debt and can eventually claim the property if the owner doesn’t pay.

Judgment Liens

When someone wins a lawsuit and obtains a money judgment, they can record that judgment with the county clerk to create a lien against the debtor’s real property. In Texas, judgment liens last for 10 years and can be renewed for additional 10-year periods.

Judgment liens attach to all real property the debtor owns in the county where the judgment is recorded. Recording in multiple counties extends the lien to property in those locations. These liens must generally be satisfied before the property can be sold or refinanced with clear title.

Federal and State Tax Liens

The IRS and Texas Comptroller can file liens against property owners who fail to pay income taxes, franchise taxes, or other obligations. Federal tax liens are particularly powerful—they attach to all property and rights to property the taxpayer owns or acquires during the lien period.

These liens remain in place until the tax debt is paid, the statute of limitations expires, or the taxing authority releases them. They can seriously complicate property transactions and often require professional assistance to resolve.

HOA and Assessment Liens

Homeowners association liens secure unpaid dues, assessments, and fines. In Texas, HOA liens can be established through the property’s dedicatory instruments (the CC&Rs). Some HOA liens have foreclosure rights, allowing the association to force a sale of the property for unpaid amounts.

Municipal assessment liens work similarly, securing payment for improvements like sidewalks, sewer connections, or street paving that benefit specific properties.

How Do Mechanic’s Liens Work for Texas Contractors?

For construction professionals, mechanic’s liens represent the most relevant and frequently used lien type. The process involves specific steps, strict deadlines, and varying requirements based on your position in the contracting chain.

The Texas mechanic’s lien system distinguishes between “original contractors” (those with direct contracts with property owners) and “derivative claimants” (subcontractors, sub-subcontractors, and suppliers). This distinction matters because it determines what notices you must send and when you must file.

Filing Requirements by Contractor Type

Original contractors have a relatively straightforward process. They must file a lien affidavit with the county clerk within specific timeframes—by the 15th day of the fourth month after completion for commercial projects, or the 15th day of the third month for residential work. No preliminary notice to the property owner is required.

Subcontractors and suppliers face additional hurdles. Before filing a lien affidavit, they must send a notice of unpaid claim to both the property owner and the original contractor. Commercial project subcontractors must send this notice by the 15th day of the third month after providing labor or materials. Residential project subcontractors have tighter deadlines—the 15th day of the second month.

Missing these deadlines eliminates your lien rights entirely. There are no extensions or exceptions for not knowing the rules.

Recent Changes to Texas Lien Law

House Bill 2237, effective January 2022, brought significant changes to Texas construction lien law. The legislation clarified notice requirements, added design professionals (architects, engineers, surveyors) to the list of those entitled to liens, and streamlined certain procedural elements.

More recently, Senate Bill 929 addressed deadline calculations. When a filing deadline falls on a Saturday, Sunday, or legal holiday, the deadline now extends to the next business day. This seemingly small change has prevented countless contractors from losing their rights due to calendar technicalities.

What Is the Priority of Different Lien Types in Texas?

Lien priority determines who gets paid first when a property is sold or foreclosed. Generally, the “first in time, first in right” principle applies—liens recorded earlier take priority over those recorded later. However, several important exceptions exist.

Property tax liens almost always take first priority, regardless of when other liens were recorded. This reflects public policy favoring tax collection over private debts.

Mechanic’s liens receive special treatment under Texas law. Their priority relates back to the “inception” of the lien—typically when visible construction begins or materials first arrive on site. This means a mechanic’s lien can take priority over a mortgage recorded after construction started, even if the lien affidavit was filed later.

Purchase money mortgages (loans used to buy the property) generally maintain priority over mechanic’s liens that arise from subsequent improvements, protecting lenders who financed the original acquisition.

5 Key Facts About Types of Property Liens in Texas

Understanding these fundamentals helps property owners and contractors navigate lien issues effectively:

- Homestead protections have limits. While Texas strongly protects homesteads from creditors, mechanic’s liens can attach to homestead property if proper procedures are followed—including a written contract signed by both spouses and filed with the county clerk before work begins.

- Lien waivers must follow specific forms. Texas Property Code Section 53.281 establishes mandatory language for lien waivers. Waivers that don’t substantially comply with these forms may be unenforceable.

- Filing a lien doesn’t guarantee payment. A recorded lien affidavit is just the first step. To actually collect, you must file a lawsuit to foreclose the lien within one to two years, depending on the project type.

- Owners can require lien releases. Property owners routinely require lien releases from contractors before making final payment. These documents confirm that workers and suppliers have been paid and won’t file liens.

- Bond claims offer an alternative for public projects. Mechanic’s liens can’t attach to government-owned property. Instead, contractors on public projects must pursue bond claims against the payment bonds that public entities require.

How Do Liens Affect Property Sales and Refinancing?

Liens create clouds on title that must be addressed before most real estate transactions can close. Title companies search public records to identify existing liens and typically require their satisfaction or release before issuing title insurance.

For sellers, undiscovered liens can derail transactions at the last minute. A judgment lien from an old lawsuit, an HOA lien for unpaid dues, or a mechanic’s lien from a contractor dispute can all surface during title searches.

Buyers generally won’t accept property with outstanding liens unless the purchase price is adjusted or the liens are paid from sale proceeds. Lenders refuse to make loans secured by property with superior liens that could wipe out their security interest in foreclosure.

Property owners should periodically check county records for liens against their property, especially before listing for sale. Addressing lien issues proactively costs far less than discovering them during a time-sensitive transaction.

What Should Contractors Do to Protect Their Lien Rights?

The types of property liens in Texas available to construction professionals offer powerful protection—but only if you follow the rules precisely. Here’s what matters most:

Document everything from day one. Keep copies of contracts, change orders, invoices, and delivery tickets. Note the dates when work was performed and materials were delivered. This information becomes critical when calculating deadlines and proving your claim.

Know your deadlines cold. Mark lien filing deadlines on your calendar the moment you start a project. Build in buffer time—don’t wait until the last day to prepare and file documents.

Send notices even when relationships are good. Many contractors skip preliminary notices because they don’t want to alarm property owners or damage relationships with general contractors. This is a mistake. Notices preserve your rights; you don’t have to file a lien just because you sent a notice.

Verify property information before filing. Lien affidavits must contain accurate legal descriptions and owner information. Errors can invalidate your lien. Use county appraisal district records or title company resources to confirm details.

Frequently Asked Questions About Property Liens in Texas

How long does a mechanic’s lien last in Texas? A mechanic’s lien remains effective until you file a lawsuit to enforce it. You must file suit within one year after the last day you could have filed the lien affidavit (for most projects) or within two years if you and the property owner agree to an extension in writing. After that, the lien becomes unenforceable.

Can a lien be placed on my property without my knowledge? Yes. Involuntary liens like judgment liens, tax liens, and mechanic’s liens can attach to your property without your consent or advance notice. Property owners should periodically search county records for liens and address any issues promptly.

What’s the difference between a lien and a levy? A lien is a claim against property that secures a debt. A levy is the actual seizure of property to satisfy that debt. Liens must typically be foreclosed through legal proceedings before property can be seized and sold.

Do I need an attorney to file a mechanic’s lien in Texas? No. Texas law allows individuals and companies to prepare and file their own lien documents. The process requires attention to detail and strict deadline compliance, but legal representation isn’t mandatory. Many contractors find that online filing services provide the guidance they need without attorney fees.

Protect Your Payment Rights Today

Understanding the types of property liens in Texas empowers contractors to protect their hard-earned income and helps property owners navigate potential claims against their real estate. The rules are technical, the deadlines are unforgiving, and the stakes are high—but the system works for those who understand it.

For contractors dealing with unpaid invoices on Texas construction projects, Texas Easy Lien simplifies the entire lien filing process. Prepare, notarize, file, and mail your documents online in minutes—no expensive attorney required. Get started today and take the first step toward getting paid what you’re owed.