Texas lien law changed in 2025, and if you file liens, you need to know about it.

- Senate Bill 929, signed May 21, 2025, officially extends lien deadlines that fall on weekends or holidays to the next business day.

- House Bill 2237 from 2022 still governs most lien procedures, including simplified notice requirements and expanded delivery methods.

- Different deadlines apply depending on whether you’re an original contractor, subcontractor, or supplier, and whether you’re working on commercial or residential projects.

- Missing a single deadline can completely invalidate your lien rights and cost you thousands in unpaid work.

If you’re a contractor in Texas, staying current on these changes is how you protect your right to get paid.

Getting paid for your work shouldn’t require a law degree. But with Texas having some of the strictest lien laws in the country, missing a deadline or skipping a required notice can mean losing your right to payment entirely.

According to Rabbet’s 2024 Construction Payments Report, 82% of contractors face payment waits exceeding 30 days. Slow payments cost the U.S. construction industry an estimated $280 billion in 2024 alone. When payments don’t come through, mechanic’s liens become your strongest legal tool for recovering what you’re owed.

Texas construction lien law updates can feel overwhelming when you’re already juggling projects, crews, and cash flow. But understanding the key changes keeps you protected and ready to act when a client doesn’t pay. Let’s break down what you actually need to know.

What Are the Biggest Texas Construction Lien Law Updates for 2025?

The most impactful Texas construction lien law updates for 2025 came through Senate Bill 929, which Governor Greg Abbott signed into law on May 21, 2025. This legislation went into effect immediately and addresses a problem that has tripped up contractors for years.

How Does Senate Bill 929 Change Lien Deadlines?

Before SB 929, contractors faced real uncertainty when lien deadlines fell on weekends or holidays. The 15th of the month might land on a Saturday, and the law wasn’t crystal clear about whether you needed to file early or could wait until Monday. Some contractors played it safe and filed early. Others waited and risked their lien rights.

SB 929 clarifies this issue once and for all. Under the updated Texas Property Code Section 53.003(e), if any deadline for providing notice or taking action under Chapter 53 falls on a Saturday, Sunday, or legal holiday, the deadline automatically extends to the next business day. This change applies across the board to all lien-related deadlines, not just filing dates.

For example, if August 15, 2025 falls on a Friday but is also a state holiday, your deadline extends to Monday, August 18. You won’t lose your lien rights because of calendar timing anymore.

Why This Matters for Your Business

This change brings Texas lien law in line with how most other legal deadlines work. It eliminates a trap that caught many contractors off guard, especially those working without dedicated legal support. The new lien laws in Texas provide breathing room on tight deadlines without changing the base timeline requirements.

The deadline extension is a nice safety net. However, the safest approach is to file several days before any deadline to account for unexpected issues with notarization, county filing systems, or delivery confirmation.

How Does House Bill 2237 Continue to Shape Texas Property Lien Laws?

While SB 929 grabbed headlines in 2025, the foundation of current Texas property lien laws still rests on House Bill 2237, which took effect January 1, 2022. Any original contract signed on or after that date operates under these rules. If you’re working on projects that started in the last few years, HB 2237 governs your lien process.

The 2022 reforms are the most comprehensive overhaul of Texas lien law in decades. Industry stakeholders, including contractors, subcontractors, owners, and lenders, collaborated to create a more efficient system. Understanding these changes helps you navigate lien law deadlines with confidence.

Expanded Delivery Methods for Notices

One of the most practical changes involves how you can deliver required notices. Previously, Texas law required certified mail or in-person delivery for all lien notices. HB 2237 expanded this to include “any other form of traceable, private delivery or mailing service that can confirm proof of receipt.”

You can now use FedEx, UPS, or similar services for your pre-lien notices and other required communications. The key requirement is proof of receipt, so regular mail still won’t cut it. But having more options makes compliance easier, especially when deadlines are tight.

Simplified Notice Requirements

Before 2022, second-tier subcontractors faced confusing dual notice requirements that created unnecessary complexity. HB 2237 streamlined this system. First-tier and second-tier subcontractors now use the same standardized notice forms and follow the same basic timeline structure.

The law also introduced standardized form language for notices, reducing the risk that your notice will be challenged for technical deficiencies. When you understand what a pre-lien notice requires, compliance becomes much more straightforward.

What Are the Current Lien Deadlines for Subcontractors and Suppliers?

Lien deadlines for subcontractors in Texas follow a monthly calculation system that trips up many contractors. Your deadlines depend on when you performed work, not when you sent an invoice or expected payment. Getting this timing right is essential for preserving your lien rights.

Commercial Project Deadlines

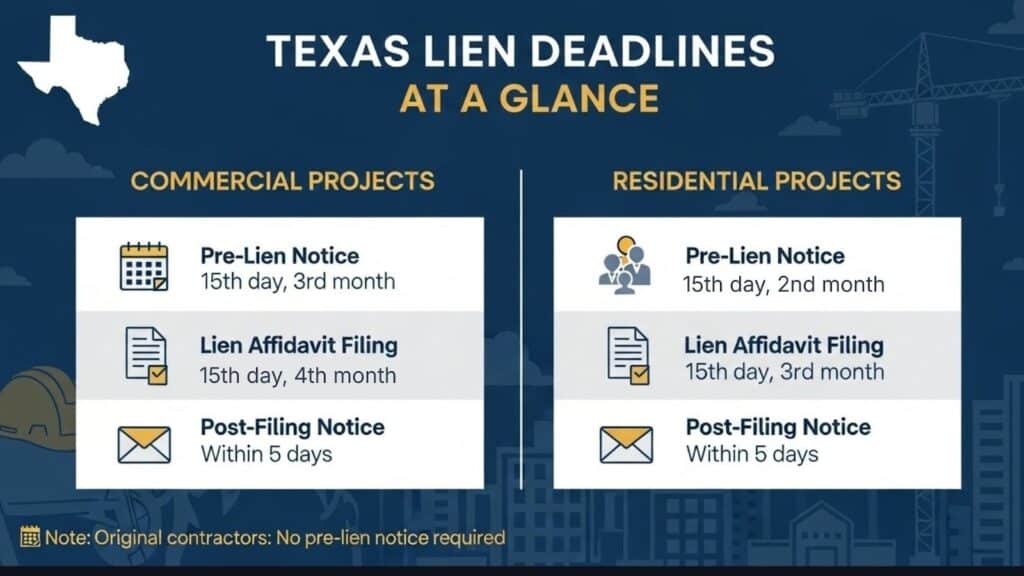

For commercial construction projects, subcontractors and suppliers must follow these critical dates:

Pre-Lien Notice Deadline: By the 15th day of the third month after you performed unpaid work. If you completed electrical installation in January, your pre-lien notice must be sent by April 15.

Lien Affidavit Filing Deadline: By the 15th day of the fourth month after you performed unpaid work. Using the same January example, your lien affidavit must be filed by May 15.

Post-Filing Notice: Within 5 days of filing your lien affidavit, you must send copies to the property owner and original contractor.

Residential Project Deadlines

Residential projects operate under tighter timelines. A residential construction project means work on a property where the owner will actually live, not investment properties or spec homes.

Pre-Lien Notice Deadline: By the 15th day of the second month after performing unpaid work.

Lien Affidavit Filing Deadline: By the 15th day of the third month after performing unpaid work.

These shorter windows mean residential contractors must act faster to protect their rights. Missing even one deadline makes your lien unenforceable, regardless of how much money you’re owed.

Original Contractor Deadlines

Original contractors, or those with direct contracts with property owners, have a simpler path. You don’t need to send pre-lien notices because you already have a direct relationship with the owner. However, you still face strict filing deadlines.

For commercial projects, original contractors must file their lien affidavit by the 15th day of the fourth month after the contract was completed, terminated, or abandoned. For residential projects, that deadline tightens to the 15th day of the third month.

Who Gained New Lien Rights Under Recent Law Changes?

Texas construction lien law updates have expanded protection for design professionals in ways that matter for architects, engineers, and surveyors. Before the 2022 changes, these professionals had limited ability to file liens unless they contracted directly with property owners.

Design Professional Protections

Under current law, licensed architects, engineers, and surveyors who provide designs, drawings, plans, surveys, or specifications have mechanic’s lien rights even when working under another party rather than the property owner.

If you’re a design professional who provides services through a general contractor or another design firm, you now have the same legal protections as other subcontractors. You must follow the same notice requirements and deadlines, but you’re no longer left without recourse when payments don’t come through.

Landscapers and Demolition Contractors

The law also explicitly protects landscapers who provide labor, plant material, or supplies for improvements, including retention ponds, retaining walls, berms, irrigation systems, and fountains. Demolition contractors who perform labor or furnish materials for demolition work also have clear lien rights under current Texas property lien laws.

What Mistakes Cost Contractors Their Lien Rights?

Understanding the new lien laws in Texas only helps if you actually follow the requirements. Many contractors lose their lien rights through avoidable errors that proper planning could prevent.

Missing Monthly Notice Requirements

Subcontractors and suppliers must send pre-lien notices for each month they performed unpaid work. If your project spanned January through March and you haven’t been paid for any of those months, you need three separate notices, each with its own deadline.

Many contractors think they can send one notice covering the entire project. That’s incorrect. Missing a monthly notice deadline for even one month of work means you can’t claim a lien for that month’s labor or materials.

Confusing Project Types

Texas law treats residential and commercial projects differently, and the definitions aren’t always obvious. A spec home being built for resale is a commercial project. A custom home being built for the owner to live in is residential. An apartment building is commercial. A duplex where the owner will occupy one unit might be residential.

Getting the project type wrong means using the wrong deadlines. Filing a lien under commercial timelines on a residential project could invalidate your entire claim.

Paperwork Errors in the Affidavit

Your lien affidavit must contain specific information required by Texas Property Code Section 53.054. This includes a sworn statement of the claim amount, the property owner’s name and address, a description of work performed, and a legally sufficient property description.

Errors in property descriptions are especially common. Using a street address instead of the legal description can create problems. Misidentifying the property owner or original contractor weakens your claim. Every detail matters when your lien might need to hold up in court.

How Can You Stay Compliant With Texas Lien Law Requirements?

Protecting your lien rights requires systems and attention to detail. Here’s how successful contractors stay on top of lien law deadlines and requirements.

Track Work Dates, Not Invoice Dates

Your lien timeline starts when you perform work, not when you send a bill. Create a system for documenting the exact dates when labor was performed or materials were delivered. This information determines every deadline that follows.

Build in Buffer Time

Don’t file on deadline day. County offices have different hours and acceptance windows. Electronic filing systems can experience outages. Notarization appointments might fall through. Planning to complete each step several days before the deadline protects you from unexpected problems.

Use Standardized Forms

The 2022 law changes introduced standardized notice forms that meet all legal requirements. Using these forms, rather than creating your own, reduces the risk that your notice will be challenged on technical grounds.

Keep Proof of Everything

Document every notice you send and every filing you make. Keep copies of certified mail receipts, delivery confirmations, and county filing stamps. If a dispute ever reaches court, this documentation proves you followed proper procedures.

Frequently Asked Questions

What is the most important Texas lien law change in 2025?

Senate Bill 929, signed into law May 21, 2025, clarifies that when any lien deadline falls on a Saturday, Sunday, or legal holiday, the deadline extends to the next business day. This eliminates previous uncertainty about weekend and holiday deadlines.

Do I need to send a pre-lien notice if I’m a general contractor?

No. Original contractors who have direct contracts with property owners are not required to send pre-lien notices in Texas. However, you still must file your lien affidavit within the required timeframe, which is the 15th day of the fourth month after completion for commercial projects or the 15th day of the third month for residential projects.

How are lien deadlines calculated in Texas?

Texas uses a monthly calculation system based on when you performed work, not when you sent invoices. For commercial projects, subcontractors must send pre-lien notices by the 15th of the third month after unpaid work and file lien affidavits by the 15th of the fourth month. Residential projects have shorter deadlines of the second and third months, respectively.

What happens if I miss a lien deadline in Texas?

Missing a lien deadline typically invalidates your mechanic’s lien for that claim. Texas courts apply these deadlines strictly, and there are generally no exceptions for contractors who file late. Once your deadline passes, you lose the ability to place a lien on the property for that work.

Protect Your Payment Rights and Get Paid Faster

Texas construction lien law updates in 2025, particularly Senate Bill 929’s deadline clarifications, give contractors more certainty about filing requirements. Combined with the streamlined processes from House Bill 2237, Texas property lien laws now provide clearer paths to protecting your payment rights.

But knowing the law and actually filing a compliant lien are two different things. The complexity of lien deadlines for subcontractors, the different requirements for residential versus commercial projects, and the technical precision required in lien affidavits create real challenges for busy contractors.

Texas Easy Lien simplifies this entire process. You can prepare, notarize, file, and mail your lien documents online in about 15 minutes, spending a fraction of what an attorney would charge. Get started with Texas Easy Lien and protect your right to get paid without the legal headaches.