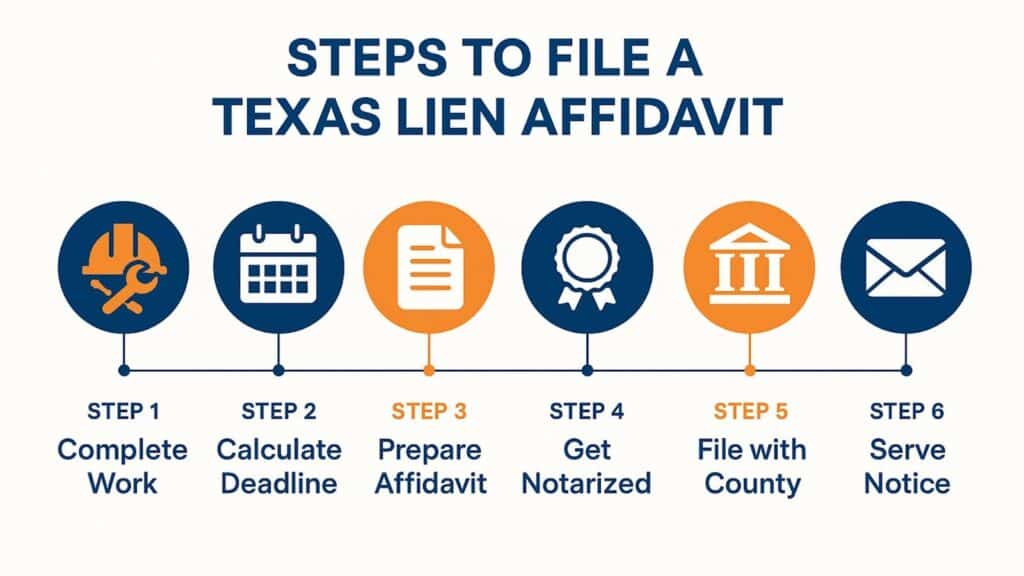

Writing a proper lien affidavit in Texas requires specific information, correct formatting, and timely filing to protect your payment rights.

- Include all required elements: claimant details, property description, work performed, and amount owed

- Follow strict deadlines: 15th day of the 4th month for commercial projects, 3rd month for residential projects

- Proper notarization and county filing are essential for validity

- Serve notice within 5 days of filing to the property owner and general contractor

Get the support you need with online filing services to properly secure the payment you’re owed with less stress and more confidence.

Getting paid for your construction work shouldn’t feel overwhelming, but sometimes filing a lien affidavit in Texas becomes necessary to secure what you’re owed. Construction payment delays affect over 80% of contractors nationwide, making lien rights a critical protection tool.

A lien affidavit serves as your official declaration that you performed work or supplied materials and haven’t been compensated. While the process might seem complicated, understanding how to properly prepare this document can mean the difference between getting paid and walking away empty-handed.

Texas lien laws have specific requirements that must be followed precisely. One missing piece of information or a missed deadline can invalidate your entire claim, leaving you with no legal recourse for payment. With the right knowledge and support, you can properly file this lien form in Texas and ease some of the burden.

What Is a Lien Affidavit in Texas?

A lien affidavit is a sworn legal document that formally establishes your claim to payment by creating a lien against the property where you performed work. It’s one of the most important types of lien forms in Texas, serving as your official proof that payment is owed for completed labor or materials. This document is officially called an “Affidavit Claiming Lien” and must comply with Texas Property Code Chapter 53.

The affidavit to file a lien serves multiple purposes beyond just stating you’re owed money. It creates a public record of your claim, provides legal notice to all interested parties, and establishes your priority position among other creditors. When properly filed, it gives you the right to potentially force the sale of the property to satisfy your debt.

Texas recognizes different types of parties who can file lien affidavits, including original contractors (those with direct contracts with property owners), subcontractors, suppliers, and design professionals (architects and engineers). Each category has slightly different requirements and deadlines, making it important to know your specific role in the project.

When Do You Need to File a Lien Affidavit?

Knowing exactly when to file a lien affidavit is just as important as knowing how to write one. Missing a single deadline, even by a day, can erase your right to payment and undo all your hard work.

Filing Deadlines Matter

The timing of your lien affidavit filing is absolutely critical in Texas. First, consider your role in the project and whether it’s commercial or residential to determine which deadlines apply to you. Important: If any deadline falls on a Saturday, Sunday, or legal holiday, the deadline automatically extends to the next business day that is not a weekend or holiday.

For Original Contractors:

- Commercial projects: File by the 15th day of the 4th month after your work was completed, terminated, or abandoned.

- Residential projects: File by the 15th day of the 3rd month after completion.

For Subcontractors and Suppliers:

- Commercial projects: File by the 15th day of the 4th month after your last work or material delivery.

- Residential projects: File by the 15th day of the 3rd month after your last work.

Prerequisites Before Filing

Before you can file a valid lien affidavit, certain conditions must be met. Subcontractors and suppliers must have sent proper pre-lien notices to the property owner and general contractor within the required timeframes. These notices are warnings that give the property owner a chance to resolve payment issues before a lien is filed.

What Information is Required in a Texas Lien Affidavit?

Every valid Texas lien affidavit must contain specific information as outlined in Texas Property Code Section 53.054. Missing any of these elements can render your lien invalid.

Required Information Checklist

Claimant Information:

Your full legal name (individual or business)

Current mailing address

Physical address if different from mailing address

Property Details:

Legal description of the property (not just street address)

County where the property is located

Property owner’s name and last known address

Work and Payment Information:

Detailed description of work performed or materials supplied

Specific months when work was performed (crucial for subcontractors)

Total amount claimed as unpaid

Name and address of the party who hired you

Verification:

Statement identifying when pre-lien notices were sent (for subcontractors)

Sworn statement that the information is true and correct

Your signature or authorized representative’s signature

Step-by-Step Guide to Writing Your Lien Affidavit

Filing a lien doesn’t have to be overwhelming when you know each step to take. Follow this simple, structured process to create a valid affidavit that protects your payment rights from start to finish.

Step 1: Gather Required Documentation

Before you start writing, collect all relevant project documents, including contracts, invoices, delivery receipts, and correspondence about payment. Having these ready ensures your lien form in Texas contains accurate details that meet Property Code requirements. You’ll also need the property’s legal description, which can typically be found on the property deed, survey, or through the county appraisal district’s website.

Step 2: Identify Your Role and Requirements

Determine whether you’re an original contractor, subcontractor, or supplier, as this affects both the content requirements and deadlines. Texas lien deadlines vary based on your relationship to the property owner.

Step 3: Draft the Affidavit Header

Begin with the standard Texas affidavit format, including the state and county where the affidavit will be notarized. This is typically the county where your business is located or where you’re having the document notarized.

Step 4: Complete the Sworn Statement

Write your sworn statement in first person, clearly stating your name, role, and authority to make the claim. Be specific about dates, amounts, and the nature of work performed.

Annotated Texas Lien Affidavit Example

Here’s a detailed Texas lien affidavit example with explanations for each section:

THE STATE OF TEXAS COUNTY OF HARRIS

[This identifies where the affidavit to file a lien is being notarized, not necessarily where the property is located]

AFFIDAVIT CLAIMING LIEN

BEFORE ME, a notary public in and for the State of Texas, on this day personally appeared [Your Name], who being by me duly sworn on oath states:

Section 1: Claimant Identification “My name is John Smith. I am the owner of Smith Roofing LLC, and I am authorized to make this affidavit on behalf of the company as the sworn statement of its claim.”

[Clearly establish who is making the claim and their authority to do so]

Section 2: Work Description and Timeline “Claimant furnished labor and materials for the improvement of the following described property in Harris County, Texas: [Insert complete legal description]. The labor and materials consisted of complete roof replacement, including tear-off of existing shingles, installation of new underlayment, and installation of architectural shingles. Work was performed during the months of January and February 2025.”

[Be specific about both the work performed and the exact months, as this information is vital for deadline calculations]

Section 3: Financial Details “The agreed contract price for said labor and materials was $25,000. Claimant has been paid $15,000, leaving a balance due and unpaid of $10,000, for which this lien is claimed.”

[State the total contract amount, payments received, and balance due]

Section 4: Contracting Party Information “Said labor and materials were furnished under a contract with ABC Construction Company, whose last known address is 123 Main Street, Houston, TX 77001.”

[Identify who hired you and their contact information]

Section 5: Property Owner Information “The name of the owner or reputed owner of said property is XYZ Development LLC, whose last known address is 456 Oak Avenue, Houston, TX 77002.”

[Property owner details. Note that this may be different from who hired you.]

Section 6: Notice Compliance (For Subcontractors) “Notice of this claim was sent to the owner and original contractor by certified mail on March 15, 2025, as required by Texas Property Code Section 53.056.”

[Document that you provided proper pre-lien notice]

Formatting Tips for Professional Presentation

A clear, well-organized lien affidavit looks professional and helps prevent delays or rejections. Use these tips to make sure your document meets Texas standards and is easy for officials to process.

Use Clear, Professional Language

Avoid construction jargon or technical terms that might confuse a court clerk or judge. Write in plain English while maintaining the formal tone required for legal documents. Instead of “hung rock,” write “installed drywall.” Replace “rough-in” with “installed electrical wiring framework.”

Organize Information Logically

Structure your affidavit to file a lien so the information flows naturally from general to specific. Start with who you are, then describe what you did, when you did it, and how much you’re owed. This logical progression makes it easier for readers to understand your claim.

Double-Check All Dates and Amounts

Accuracy is essential in legal documents. Verify all dates against your project records and ensure mathematical calculations are correct. A simple error could raise questions about the reliability of your entire claim.

Save Time with Online Filing Support

Preparing and filing lien documents doesn’t have to be a headache. Use online services to prepare, notarize, and file your lien documents quickly and accurately. They streamline the entire process, help you avoid common filing mistakes, and keep you on schedule with Texas lien deadlines, all without leaving your job site.

How Do You Notarize Lien Affidavits?

Before your lien affidavit becomes legally valid, it must be notarized. This simple but critical step confirms your identity and ensures your document can be officially accepted by the county clerk.

What Notarization Accomplishes

Notarization serves as official verification that you are who you claim to be and that you signed the document voluntarily. In Texas, this step is absolutely required. An unnotarized lien affidavit is worthless.

Step-by-Step Notarization Process

Prepare Your Documents: Have your completed affidavit ready, along with a valid government-issued photo ID. Don’t sign the document yet. You must sign in the notary’s presence.

Find a Qualified Notary: Any Texas-commissioned notary public can notarize your affidavit. Many banks, title companies, and shipping stores offer notary services. Online notarization is also available through various platforms.

Verify Your Identity: The notary will check your ID and confirm you are the person named in the affidavit. They may ask questions about the document to ensure you understand what you’re signing.

Sign in the Notary’s Presence: Sign the affidavit while the notary watches. The notary will then complete their portion, including their signature, seal, and commission information.

Obtain Copies: Get several certified copies of the notarized affidavit. You’ll need copies for filing with the county, serving on parties, and your own records.

What Are Common Mistakes That Invalidate Lien Affidavits?

Even a small mistake can make your lien useless in Texas. Before you file, make sure your paperwork is complete, accurate, and on time. One overlooked detail can cost you the payment you’ve worked hard to earn.

Insufficient Property Description

Using only a street address instead of the legal property description is one of the most common errors. While courts sometimes accept substantial compliance, why risk it? Always use the complete legal description found on the deed or survey.

Missing or Incorrect Deadlines

Texas mechanic’s lien laws are unforgiving when it comes to deadlines. Calculate your filing deadline carefully, accounting for weekends and holidays. If the 15th falls on a weekend, the deadline extends to the next business day.

Inadequate Work Description

Vague descriptions like “construction work” or “materials” won’t suffice. Provide enough detail that someone unfamiliar with your project could understand exactly what you did. This information protects you if questions arise about the validity of your claim.

Failure to Include All Required Parties

Make sure you identify everyone correctly, including the property owner, the party who hired you, and any general contractors. Incorrect or missing party information can invalidate your lien.

How Do You File and Serve Your Lien Affidavit?

Once your lien affidavit is signed and notarized, the next step is to make it official through proper filing and notification. Following the right procedures ensures your claim is recorded correctly and fully protects your right to payment.

County Filing Requirements

Once notarized, file your lien form in Texas with the county clerk in the county where the property is located to make your claim official and legally enforceable. Each county has different filing fees, typically ranging from $25 to $50. The clerk will record your affidavit in the real property records and provide you with a filed copy showing the recording information.

Notice Requirements After Filing

Within five days of filing, you must send copies of the filed affidavit to the property owner and, if you’re a subcontractor, to the general contractor. This notice must be sent by certified mail or another traceable method to their last known addresses. Keep the receipts as proof of compliance.

Enforcement Considerations

Filing a lien affidavit doesn’t automatically get you paid. It simply preserves your right to pursue payment through legal action. You typically have one year from the filing deadline to file a lawsuit to foreclose the lien. Many contractors find that simply filing the lien motivates property owners to resolve payment disputes without litigation.

Frequently Asked Questions

Can I file a lien affidavit without sending a pre-lien notice first? Original contractors (those with direct contracts with property owners) don’t need to send pre-lien notices. However, subcontractors and suppliers must send proper pre-lien notices before filing lien affidavits, or their liens will be invalid.

What happens if I make a mistake in my lien affidavit? Minor errors might not invalidate your lien if courts determine you substantially complied with the requirements. However, significant mistakes like wrong amounts, missing deadlines, or incorrect property descriptions can make your lien worthless. It’s better to be precise from the start.

Can I file a lien affidavit on a homestead property? Yes, but homestead properties have additional requirements, including written contracts signed by both spouses (if married) and specific notice language. These requirements make homestead liens more complex to complete properly.

How long does a lien affidavit remain valid? You must file a lawsuit to foreclose your lien within one year of the deadline for filing the affidavit. If you don’t file suit within this timeframe, your lien becomes unenforceable.

File Your Lien Affidavit with Confidence

Writing a proper lien affidavit in Texas requires attention to detail, understanding legal requirements, and careful adherence to deadlines. While the process may seem complex, following these guidelines will help ensure your lien is valid and enforceable.

A lien affidavit is just one tool for collecting unpaid construction debts. The goal is always to get paid while maintaining professional relationships whenever possible. Often, the mere filing of a proper lien is enough to motivate payment without further legal action.

Don’t let the complexity of Texas lien laws prevent you from protecting your right to payment. When you need to file, Texas Easy Lien provides the tools and guidance to prepare your lien documents properly with less stress. Contact us today to learn how we can help you secure the payments you’ve earned.