Texas contractors can often file liens without written contracts, but specific rules apply.

- Constitutional liens allow original contractors to file without written agreements.

- Homestead properties require written contracts with both spouses’ signatures.

- Certain trades (surveyors, demolition) must have written contracts regardless.

- Strong documentation is essential for verbal agreement claims.

Understand your contractor type and property classification before filing to protect your payment rights.

When payment doesn’t come through on a Texas construction project, contractors often wonder if they can take action without a formal written contract. According to industry data, 72% of construction subcontractors are waiting longer than 30 days to receive payment for their work, making lien rights more important than ever. The good news? Texas law often allows you to file a lien without a contract, depending on your specific situation.

Texas mechanic’s lien laws recognize that construction work frequently begins with handshake deals, verbal agreements, or urgent project needs that don’t wait for paperwork. Understanding when you can file a lien without contract in Texas requires knowing the difference between constitutional and statutory liens, your role in the project, and the type of property involved.

When Can You File a Lien Without Contract in Texas?

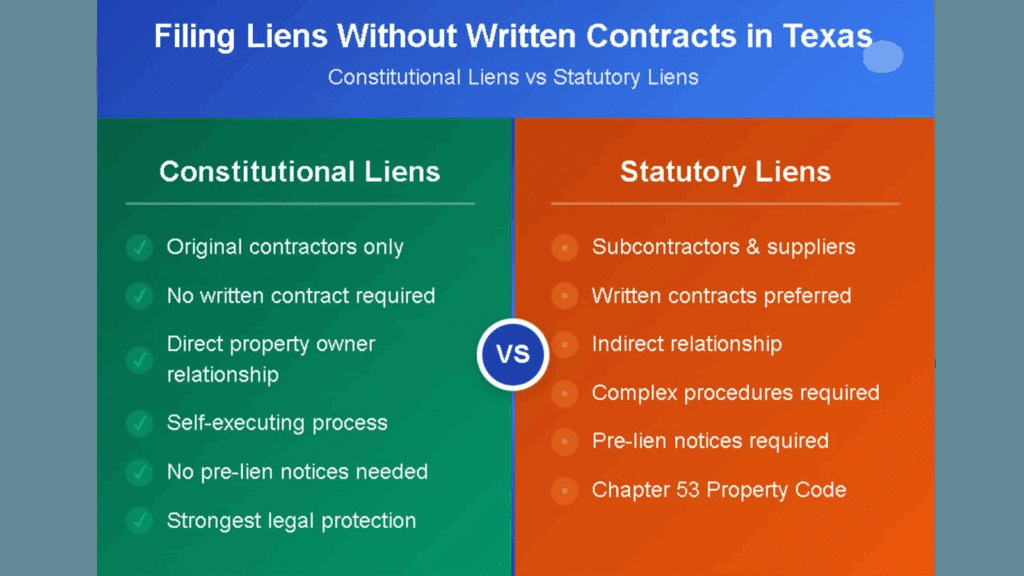

The answer to whether you can file a lien without contract in Texas depends on two key factors: your relationship to the property owner and the type of property where you performed work. Texas recognizes both constitutional and statutory liens, each with different requirements for written contracts.

Constitutional liens provide the strongest protection for contractors who work directly with property owners. These liens don’t require written contracts and are considered “self-executing,” meaning they don’t need preliminary notices or complex filing procedures. If you’re an original contractor with a direct relationship to the property owner, you can typically file a constitutional lien based on an oral agreement or even an implied contract.

Statutory liens, governed by Chapter 53 of the Texas Property Code, apply to most subcontractors and suppliers. While these liens have more complex requirements, they can often be filed without written contracts on commercial properties. The key difference lies in proving that an agreement existed and that work was performed to improve the property.

For contractors wondering about situations involving a no contract lien in Texas, the law generally supports your right to payment regardless of whether your agreement was formalized in writing. However, this protection comes with important exceptions and documentation requirements that can make or break your claim.

Property Type Matters: What Are Commercial vs Homestead Requirements?

The type of property where you performed work impacts your ability to file a lien without a written contract. Texas law treats residential homestead properties much more strictly than commercial properties, requiring specific protections for homeowners.

Commercial Property Projects

Commercial construction projects offer the most flexibility for filing liens without written contracts. Whether you’re working on office buildings, retail spaces, industrial facilities, or residential properties that aren’t homesteads (like rental properties or spec homes), oral agreement liens are generally sufficient under Texas law.

For commercial projects, first-tier subcontractors can file statutory liens based on verbal agreements, provided they send proper pre-lien notices and meet filing deadlines. The same applies to material suppliers and most other construction professionals working on these projects.

Homestead Property Restrictions

Homestead properties require written contracts before any contractor can file a valid lien. Under Section 53.254 of the Texas Property Code, the original contractor must execute a written contract with the property owner before any work begins. This contract must be signed by both spouses if the owner is married, and it must be filed with the county clerk.

This homestead protection extends to all subcontractors working on the project. Even if a subcontractor has a written agreement with the general contractor, they cannot file a lien on homestead property unless the original contractor properly executed and filed the required written contract with the property owner.

Understanding lien requirements in Texas for homestead properties can prevent costly mistakes that invalidate your lien rights entirely.

What Are the Contract Requirements for Different Contractor Roles?

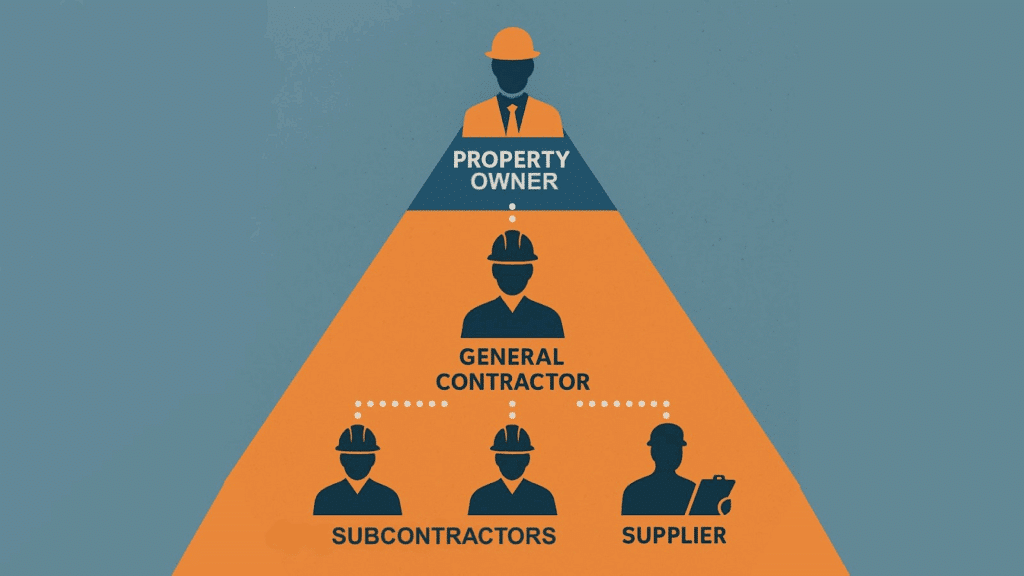

Your position in the construction hierarchy determines both your lien rights and contract requirements. Texas law recognizes different obligations for original contractors, subcontractors, and specialized service providers.

Original Contractors

Original contractors who work directly with property owners have the strongest position for filing liens without written contracts. They can assert constitutional liens that don’t require preliminary notices or complex procedural requirements. As long as there’s evidence of an agreement and work performed, oral agreement liens are generally sufficient for constitutional lien claims.

Subcontractors and Suppliers

Subcontractors face more complex requirements but can still file liens based on verbal agreements in most situations. First-tier subcontractors (those working directly for the general contractor) must send pre-lien notices and follow specific filing deadlines, but written contracts aren’t required for commercial projects.

Second-tier subcontractors and suppliers have the same rights but must notify additional parties in the construction chain. The key is maintaining documentation that proves the agreement existed and work was performed.

Special Trade Requirements

Certain construction professionals must have written contracts regardless of property type. Under Texas law, surveyors and demolition contractors cannot file valid liens without written agreements. These requirements apply whether you’re working on commercial or residential projects, making written contracts essential for these specialized trades.

Architects, engineers, and other design professionals gained expanded lien rights under recent law changes, but written agreements remain the safest approach for these professionals to protect their payment rights.

What Essential Documentation Is Needed for Verbal Agreements?

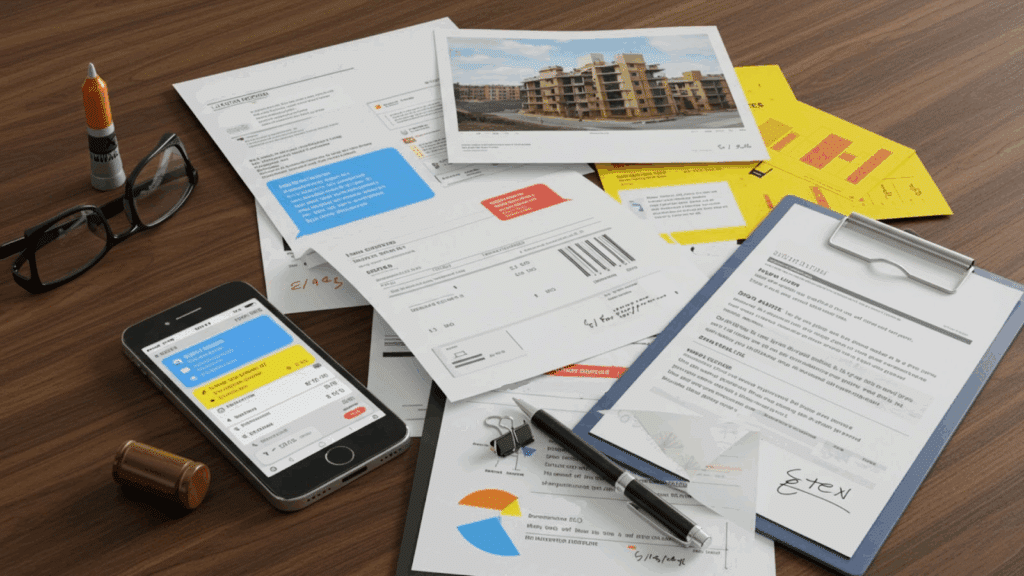

When filing a lien without a contract in Texas, strong documentation becomes your lifeline for proof. Courts and property owners will scrutinize oral agreement liens more carefully, making comprehensive record-keeping essential.

Critical Documentation Elements

Communication Records: Save all text messages, emails, voicemails, and written communications that reference the project scope, pricing, or work schedule. These records help establish the terms of your verbal agreement and show ongoing acknowledgment of the work relationship.

Work Performance Evidence: Document your work with photographs showing progress at different stages, daily work logs with descriptions of tasks completed, and material delivery receipts with dates and locations. This evidence proves you actually performed the work claimed in your lien.

Payment Records: Maintain detailed invoices with project descriptions and amounts owed, records of any partial payments received, and documentation of payment requests or demands. These records establish the financial relationship and outstanding debt.

Project Documentation: Keep copies of any project plans, specifications, or change orders you received, permit applications that include your company information, and inspection records or sign-offs that mention your work. This documentation helps prove the scope and legitimacy of your project involvement.

Third-Party Verification: Collect witness statements from other contractors or workers who observed your work, delivery confirmations from material suppliers, and any acknowledgments from the property owner or general contractor about your work or payment obligations.

The strength of your documentation often determines whether a no contract lien in Texas will hold up under scrutiny. Payment delays are costing the construction industry $280 billion annually, making solid documentation practices essential for protecting your rights.

Step-by-Step Filing Process Without a Contract

Filing a lien without a written contract requires careful attention to requirements and deadlines. Missing any step can invalidate your claim, regardless of how much work you performed or money you’re owed.

Start by determining your exact role in the construction project and the type of property involved. Original contractors filing constitutional liens have simpler requirements, while subcontractors must follow statutory lien procedures. Residential homestead projects require written contracts, so verify the property classification before proceeding.

Gather and organize all documentation supporting your claim. This includes communication records, work photos, invoices, and any other evidence of the agreement and work performed. Create a timeline showing when work was performed, as Texas lien deadlines are calculated from specific work dates, not invoice dates.

For subcontractors and suppliers, send required pre-lien notices to the property owner and general contractor. Commercial projects require notices by the 15th day of the third month after work was performed, while residential projects require notices by the 15th day of the second month.

Prepare your lien affidavit with all required information, including the amount claimed, property description, work performed, and your contact information. The affidavit must be notarized and filed with the county clerk in the county where the property is located.

File your lien affidavit by the applicable deadline. For commercial projects, this date is typically the 15th day of the fourth month after your work was completed. Residential projects have shorter deadlines, requiring filing by the 15th day of the third month.

After filing, send copies of the filed lien to the property owner and general contractor within five days. Use certified mail or another trackable delivery method to prove compliance with notice requirements.

What Are 5 Common Mistakes That Invalidate Your Lien?

Even contractors with strong oral agreement liens can lose their rights through mistakes. Understanding these common errors helps you avoid costly pitfalls that could leave you without payment recourse.

1. Deadline Miscalculations

Many contractors incorrectly calculate lien deadlines by using invoice dates instead of work performance dates. Texas law bases all lien filing deadlines on when work was actually performed, regardless of when you sent bills or expected payment. Track work completion dates for each month separately, as different months may have different deadline requirements.

2. Insufficient Documentation

Failing to maintain adequate records of verbal agreements often dooms lien claims. Courts require clear evidence that an agreement existed and work was performed. Contractors who rely solely on their word without supporting documentation frequently lose lien enforcement actions, even when they clearly performed valuable work.

3. Improper Notice Recipients

Subcontractors must send pre-lien notices to all required parties, including property owners, general contractors, and sometimes other subcontractors in the chain. Missing any required recipient invalidates the notice and destroys lien rights. Second-tier subcontractors have particularly complex notice requirements that trip up many contractors.

4. Property Classification Errors

Misunderstanding whether a project qualifies as residential homestead property leads to invalid lien filings. Many projects that appear residential actually fall under commercial classification, including rental properties, spec homes, and investment properties. Filing on actual homestead property without proper written contracts violates Texas law and can result in fraudulent lien penalties.

5. Filing in the Wrong County

Liens must be filed in the county where the improved property is located, not where your business is based or where you signed agreements. This distinction seems simple but becomes complicated when properties span multiple counties or when contractors assume filing location based on convenience rather than legal requirements.

With 82% of all contractors facing payment delays, avoiding these mistakes protects your financial interests when dealing with unpaid work.

How to Protect Your Rights When Contracts Are Unclear

Even with strong documentation and proper procedures, filing liens without written contracts carries additional risks that contractors should understand and mitigate. Taking proactive steps to strengthen your position can make the difference between successful payment recovery and costly legal disputes.

When working on projects without formal contracts, establish clear communication patterns from the beginning. Send detailed emails confirming project scope, pricing, and schedules after verbal discussions. Request written acknowledgment of change orders or additional work, even if it’s just a text message confirmation. These communications create a paper trail that supports your oral agreement lien claims.

Build relationships with other contractors and suppliers on the project who can serve as witnesses to your work and agreements. Having independent third parties who can verify your involvement and the value of your work strengthens your position if disputes arise.

Consider requiring partial payments at regular intervals rather than waiting for project completion. This scheduling reduces your exposure to payment risk and creates documentation of the ongoing payment relationship. Partial payments also provide evidence that the property owner acknowledged your work and accepted your pricing.

Monitor the project’s financial health and payment patterns throughout construction. If you notice other contractors experiencing payment delays or if the general contractor seems financially stressed, take protective action early. Filing pre-lien notices promptly protects your rights and may encourage faster resolution of payment issues.

Stay informed about current lien law changes and requirements that could affect your rights. Texas lien law has evolved in recent years, and staying current with procedural requirements helps ensure your filings remain valid and enforceable.

FAQs

Can I file a lien on a residential property without a written contract? No, residential homestead properties require written contracts signed by both spouses (if married) and filed with the county clerk before any lien can be valid. This applies to all contractors and subcontractors working on homestead property.

What’s the difference between a constitutional lien and a statutory lien in Texas? Constitutional liens are available to original contractors who work directly with property owners and don’t require written contracts or pre-lien notices. Statutory liens apply to most subcontractors and suppliers, requiring specific notices and procedures but often allowing oral agreements on commercial properties.

How long do I have to file a lien without a written contract? Filing deadlines depend on your role and property type. Original contractors typically have until the 15th day of the fourth month (commercial) or third month (residential) after work completion. Subcontractors must also send pre-lien notices by earlier deadlines to preserve their rights.

What documentation do I need to support an oral agreement lien? Essential documentation includes communication records (texts, emails), work performance evidence (photos, invoices), payment records, project documentation, and third-party verification. The stronger your documentation, the better your chances of successful lien enforcement.

Are there any trades that must have written contracts to file liens? Yes, surveyors and demolition contractors must have written contracts regardless of property type. Other specialized professionals, like architects and engineers, should also obtain written agreements to ensure the strongest possible lien rights protection.

Get Support for Protecting Your Payment Rights

While Texas law often permits contractors to file a lien without contract in Texas, success depends on understanding the specific requirements for your situation. Constitutional liens provide strong protection for original contractors with direct property owner relationships, while statutory liens offer recourse for subcontractors and suppliers who follow proper procedures.

The key to protecting your payment rights lies in thorough documentation, understanding property classifications, and meeting all procedural deadlines. Whether you’re dealing with an oral agreement lien or not, having experienced guidance can make the difference between getting paid and losing your claim entirely.

Don’t let the complexity of lien requirements in Texas prevent you from recovering what you’re owed. Texas Easy Lien simplifies the entire process, helping you prepare, file, and serve all necessary documents while ensuring compliance with current Texas law. Get started today and take control of your payment rights.