Missing Texas lien deadlines can cost you thousands in unpaid work and eliminate your legal right to collect payment.

- Residential projects have shorter deadlines than commercial (3rd month vs 4th month for most filings).

- Your role determines your specific deadline schedule. Original contractors, subcontractors, and suppliers each follow different timelines.

- All deadline calculations use the 15th day of each month, with specific months determined by when you last provided work or materials.

- Missing any single deadline completely invalidates your lien rights, regardless of the amount owed.

Master these deadline requirements to secure your payment rights and get paid faster.

Getting paid in construction should be straightforward, but construction professionals struggle with unpredictable cash flow. While invoices state 30-day due dates, the average payment wait time for subcontractors is 56 days. Fortunately, Texas liens give you powerful legal protection when clients won’t pay if you know exactly when to use them.

Understanding Texas lien deadlines is essential as construction activity continues to surge across the state. Whether you’re working on a high-rise in Dallas or a custom home in Austin, missing these strict deadlines can permanently eliminate your right to collect payment.

Why Do Texas Lien Deadlines Matter?

Texas lien laws operate on an unforgiving timeline system where missing any deadline by even one day can cost you. The state designed these deadlines to balance property owner protections with contractor payment rights, creating a structured framework that demands precision.

Construction lien deadlines in Texas follow specific patterns based on two key factors: your role in the project hierarchy and the type of property you’re working on. Unlike many other states that offer flexibility or grace periods, Texas maintains strict compliance requirements that leave zero room for error.

Missing deadlines can damage your business reputation, strain relationships with general contractors, and force you into expensive litigation with uncertain outcomes. Smart contractors treat these deadlines as non-negotiable business requirements, not suggestions.

Recent changes to Texas Property Code Chapter 53 continue affecting projects, particularly those involving contracts signed after January 1, 2022. These updates modified notice forms, extended certain deadline calculations to the next business day when the 15th falls on weekends or holidays, and clarified requirements for residential projects.

What Determines Your Texas Lien Filing Schedule?

Your lien filing schedule depends on two classifications that determine everything about your timeline requirements. Getting these wrong means following the wrong deadlines entirely.

Project Type Classification

Residential construction projects include properties where the owner will actually live, such as custom homes, major renovations, and additions to existing residences. The key factor isn’t the building type but whether the property owner intends to occupy it as their residence.

Commercial projects encompass everything else, including office buildings, retail spaces, apartment complexes, spec homes for sale, and single-family houses being built as investments. If the property owner won’t live there, it’s commercial for lien deadline purposes.

Role-Based Timeline Differences

Original contractors work directly with property owners and enjoy the most straightforward requirements. Since they communicate directly with owners, they typically skip preliminary notice requirements and face different filing deadlines.

Subcontractors and suppliers work further down the payment chain and must send advance notices to preserve their lien rights. Their deadlines are more complex because they must notify multiple parties who might not know about their involvement in the project.

Pre lien timing in Texas varies between these roles, making it essential to understand exactly where you fit in each project’s structure.

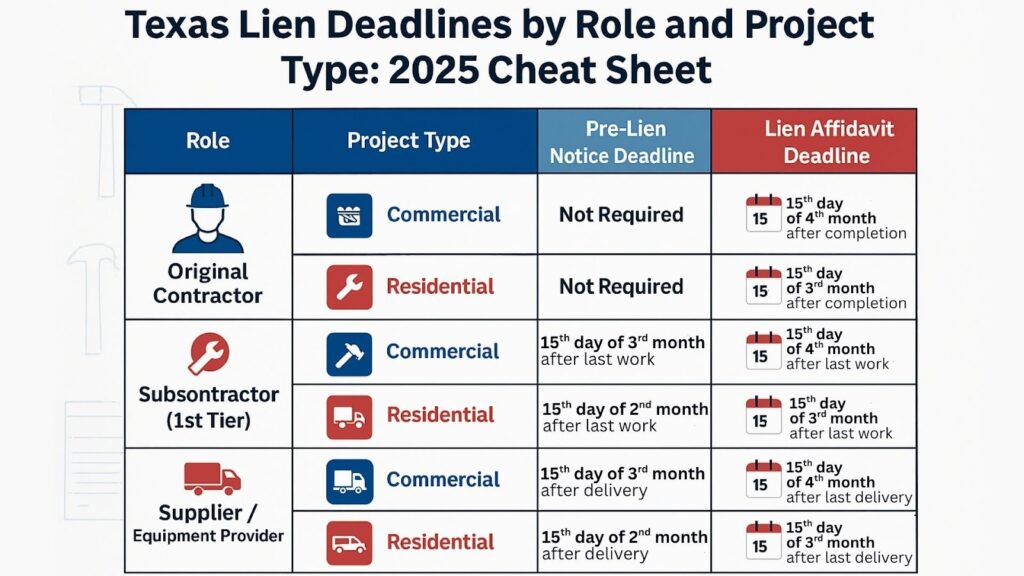

Texas Lien Deadlines by Role and Project Type: Cheat Sheet

Here’s your complete deadline reference guide, organized by contractor type and project classification. Remember: all deadlines fall on the 15th day of the specified month.

Original Contractors (Direct Contract with Property Owner)

Commercial Projects:

- No preliminary notices required

- Lien affidavit deadline: 15th day of the 4th month after completion, termination, or abandonment

- Post-filing notice: Send a copy to the owner within 5 days of recording

Residential Projects:

- Contract filing required: Must file a written contract with the county clerk before starting work

- Lien affidavit deadline: 15th day of the 3rd month after completion, termination, or abandonment

- Post-filing notice: Send a copy to the owner within 5 days of recording

Subcontractors (First-Tier: Direct Contract with General Contractor)

Commercial Projects:

- Invoice deadline: 15th day of the 2nd month after each month of work

- Pre-lien notice deadline: 15th day of the 3rd month after each month of work

- Lien affidavit deadline: 15th day of the 4th month after last work performed

Residential Projects:

- Pre-lien notice deadline: 15th day of the 2nd month after each month of work

- Lien affidavit deadline: 15th day of the 3rd month after last work performed

Sub-Subcontractors (Second-Tier: Contract with Another Subcontractor)

Commercial Projects:

- Invoice deadline: 15th day of the 2nd month after each month of work

- Pre-lien notice deadline: 15th day of the 3rd month after each month of work

- Lien affidavit deadline: 15th day of the 4th month after last work performed

Residential Projects:

- Pre-lien notice deadline: 15th day of the 2nd month after each month of work

- Lien affidavit deadline: 15th day of the 3rd month after last work performed

Material Suppliers and Equipment Providers

Commercial Projects:

- Invoice deadline: 15th day of the 2nd month after each delivery

- Pre-lien notice deadline: 15th day of the 3rd month after each delivery

- Lien affidavit deadline: 15th day of the 4th month after last delivery

Residential Projects:

- Pre-lien notice deadline: 15th day of the 2nd month after each delivery

- Lien affidavit deadline: 15th day of the 3rd month after last delivery

How Does the Step-by-Step Timeline Process Work?

Understanding the complete timeline helps you see how these deadlines connect and why each step matters for protecting your payment rights.

Phase 1: Project Documentation (Before Work Begins)

For residential projects, original contractors must file their written contract with the county clerk before starting any work. This filing creates the legal foundation for homestead lien rights and includes specific language requirements that protect both parties.

Phase 2: Monthly Tracking During Construction

Subcontractors and suppliers must track their work or deliveries month by month, not by invoice date or project completion. If you worked in January, February, and March, you need separate deadline calculations for each month’s unpaid amounts.

Invoice requirements kick in first, requiring subcontractors to bill the general contractor by the 15th of the second month after work. This step establishes the paper trail showing you requested payment before moving to more formal notice procedures.

Phase 3: Pre-Lien Notice Requirements

Pre-lien notices serve as formal warnings that payment is overdue and lien rights are at risk. These notices must include specific language mandated by Texas Property Code Section 53.056, including warnings about potential liens and detailed work descriptions.

The notice goes to both the property owner and general contractor, ensuring all parties understand the payment dispute and can take action to resolve it before liens are filed.

Phase 4: Lien Affidavit Filing

When payment issues persist, the lien affidavit creates a formal claim against the property. This sworn document must include detailed information about the work performed, amounts owed, and property descriptions that meet legal requirements for enforceability.

Phase 5: Post-Filing Notifications

After recording your lien affidavit with the county clerk, you must send copies to the property owner and general contractor within five days. This notification requirement ensures all parties know about the filed lien and can respond appropriately.

Real-World Examples: How Deadlines Work in Practice

Seeing these deadlines in action helps clarify how the monthly calculation system works for different scenarios you might encounter.

Example 1: Commercial Electrical Subcontractor

Southwest Electric completed wiring work on a Dallas office building from February 1–15, 2025. As a first-tier subcontractor on a commercial project:

- Invoice deadline: April 15, 2025 (15th of 2nd month after February)

- Pre-lien notice deadline: May 15, 2025 (15th of 3rd month after February)

- Lien affidavit deadline: June 15, 2025 (15th of 4th month after February)

Example 2: Residential Roofing Contractor

Austin Roofing worked directly with a homeowner on a custom home addition from March 10–25, 2025. As an original contractor on a residential project:

- No preliminary notices required

- Lien affidavit deadline: June 15, 2025 (15th of 3rd month after March completion)

Example 3: Multi-Month Plumbing Project

Hill Country Plumbing provided services on a commercial project spanning January, February, and March 2025. They must send separate pre-lien notices for each month:

- January work: Pre-lien notice by April 15, lien affidavit by May 15

- February work: Pre-lien notice by May 15, lien affidavit by June 15

- March work: Pre-lien notice by June 15, lien affidavit by July 15

Example 4: Materials Supplier on Residential Project

Cedar Park Supply delivered lumber for a custom home renovation in April 2025. As a supplier on a residential project:

- Pre-lien notice deadline: June 15, 2025 (15th of 2nd month after April)

- Lien affidavit deadline: July 15, 2025 (15th of 3rd month after April)

What Happens When You Miss a Texas Lien Deadline?

Missing lien deadlines in Texas creates immediate and permanent consequences that can limit your ability to collect payment. The state’s strict interpretation of these requirements means there are no second chances or grace periods.

Immediate Loss of Lien Rights

When you miss a pre-lien notice deadline, you lose your right to file a mechanic’s lien for that specific month’s work. If you worked in January but missed the April 15 pre-lien notice deadline, you can never file a lien for January’s unpaid amounts, regardless of how much money is involved.

Missing the lien affidavit deadline eliminates your lien rights entirely for the affected time period. Courts consistently rule that these deadlines are jurisdictional requirements, meaning late filing makes your claim legally invalid even if you’re owed substantial amounts.

Financial Impact on Your Business

Lost lien rights often mean lost payment entirely, especially when dealing with financially distressed property owners or general contractors. Without lien leverage, you become an unsecured creditor competing with banks, suppliers, and other creditors for limited funds.

Missing deadlines damages relationships with general contractors who expect subcontractors to manage their lien rights properly. This can cost you future work opportunities and referrals.

Legal Complications and Costs

Without lien rights, collecting payment requires expensive litigation with uncertain outcomes. Breach of contract lawsuits cost thousands in attorney fees and can take years to resolve, assuming you can prove your case and collect any judgment.

Some contractors mistakenly believe they can still file “invalid” liens to pressure payment. This strategy backfires when property owners discover the missed deadlines and can lead to malicious lien claims that result in attorney fee awards against you.

Five Essential Tips for Managing Your Lien Filing Schedule

Staying on top of construction lien deadlines means making them a regular part of your normal business operations. These strategies help prevent costly mistakes while minimizing administrative burden.

Create Project-Specific Deadline Calendars

Set up digital calendars that track critical dates for each active project. Include multiple alerts before each deadline (typically 30, 15, and 7 days in advance) to ensure adequate preparation time. Many contractors use project management software that automates these reminders and integrates with their existing workflows.

Standardize Your Information Collection Process

Develop intake forms that capture all information needed for potential liens at project startup. Gather complete property owner details, general contractor information, project addresses with legal descriptions, and contract documentation. Having this information ready prevents scrambling when deadlines approach.

Use Monthly Payment Tracking Systems

Track payments month by month rather than by invoice or project completion. Create spreadsheets or use software that clearly shows which months remain unpaid for each project, making it easy to calculate appropriate deadlines for each time period.

Build Clear Internal Workflows

Assign specific team members the responsibility for monitoring deadlines and preparing notices. Create checklists that ensure all required information is included in each notice and all recipients receive proper service. Train staff about the importance of these deadlines and the consequences of mistakes.

Use Professional Services for Complex Projects

Large or multi-phase projects often come with overlapping deadlines, multiple subcontractors, and extensive documentation requirements. In these cases, managing lien filings on your own can feel overwhelming. Using a professional lien service helps ensure that every step happens correctly and on time.

Look for tools that simplify the process. A good service should guide you through each step, check your documents for common errors, and let you handle everything online, saving hours of paperwork and costly attorney fees. Many contractors prefer this approach because it removes guesswork and reduces the risk of missing a deadline due to a small mistake.

The best solutions are designed specifically for Texas lien law, offering accurate forms, 24/7 access, and optional e-notary and filing services when you need them. They allow you to focus on running your business while knowing your lien rights are fully protected and your documents meet Texas Property Code requirements.

Frequently Asked Questions

Q: What happens if the 15th falls on a weekend or holiday in 2025? A: For contracts signed after January 1, 2022, deadlines extend to the next business day. For older contracts, deadlines move to the earliest business day.

Q: Can I file a lien for work performed across multiple months? A: Yes, but you must send separate pre-lien notices for each month’s unpaid work and calculate deadlines individually for each time period.

Q: Do suppliers need to send pre-lien notices for every delivery? A: Suppliers must send pre-lien notices for each month in which they made deliveries, following the same monthly calculation system as contractors.

Q: Are deadline requirements different for public construction projects? A: Yes, public projects use bond claims instead of liens and follow different deadline structures under Texas Government Code Chapter 2253.

Q: What information must be included in pre-lien notices to meet Texas requirements? A: Pre-lien notices must include project details, work descriptions, amounts owed, contractor information, and specific warning language required by Texas Property Code Section 53.056.

Secure Your Payment Rights with Proper Deadline Management

Mechanic’s liens serve as your most powerful tool for collecting unpaid work, but only when you understand and follow Texas lien deadlines precisely. The monthly calculation system, combined with different requirements for residential versus commercial projects, can create confusion requiring attention to detail and better management.Texas Easy Lien simplifies the entire process with easy-to-use online tools that ensure you never miss a critical deadline again. Contact us today to protect your payment rights without the hassle of managing deadlines yourself.