Missing a Texas lien deadline permanently eliminates your right to file a mechanic’s lien and secure payment through property encumbrance. You retain options including demand letters, breach of contract lawsuits, trust fund violations claims, and prompt payment act enforcement.

- Immediate consequence: Lost lien rights cannot be restored or extended.

- Financial impact: No property security means you’re an unsecured creditor.

- Alternative options: Contract lawsuits, demand letters, and statutory violations remain available.

- Action required: Document everything and pursue remaining legal remedies immediately.

Recovery success depends on quick action and proper documentation.

You’ve been waiting weeks for payment, watching the calendar, and now it’s too late. With a missed lien deadline in Texas, that sinking feeling in your stomach tells you something important just slipped away. Unpaid contractor bills remain a persistent problem across the state, making it vital to understand exactly what happens when deadlines pass.

Missing a lien deadline doesn’t mean you’re completely out of options, but it does mean your strongest collection tool is gone forever. Let’s break down exactly what you’ve lost, what you still have, and what steps you need to take right now to protect whatever rights remain.

What Exactly Happens When Facing a Missed Lien Deadline in Texas?

When you miss a lien deadline in Texas, the consequences are immediate and permanent. Texas Property Code Chapter 53 provides no lien grace period, no extensions, and no do-overs. The moment that deadline passes, your right to file a mechanic’s lien against the property vanishes completely.

This situation isn’t like missing a payment due date, where you might get charged a late fee. Missing a lien deadline in Texas means losing a fundamental legal right that cannot be restored. The law operates on strict deadlines because the mechanic’s lien system is designed to balance the rights of contractors with the rights of property owners who need a clear title to their property.

Your missed lien deadline in Texas creates an immediate shift in your legal position. You go from being a secured creditor with rights to the property itself to being an unsecured creditor who must rely on other collection methods. This change affects everything from your negotiating position to your chances of actually getting paid.

The property owner no longer faces the threat of having their property encumbered by your lien. You lose significant leverage from any payment negotiations, and property owners are often less motivated to resolve payment disputes quickly.

What Legal Consequences Do You Face?

The legal ramifications of missing your lien deadline extend beyond just losing lien rights. First, you lose what’s called a “priority position” among creditors. Mechanic’s liens often take priority over other debts, meaning if the property were sold or foreclosed upon, you’d get paid before many other creditors. Without that lien, you’re now competing with everyone else the property owner owes money to.

You also lose the ability to force a foreclosure sale of the property to satisfy your debt. This action was your nuclear option, the ability to actually force the sale of the property to collect what you’re owed. Late lien filing eliminates this powerful collection tool permanently.

Additionally, if you attempt to file a lien after the deadline has passed, you could face serious legal consequences. Texas has a Fraudulent Lien Act that imposes penalties of up to $10,000 or actual damages (whichever is greater) plus attorney fees for filing invalid liens. Courts don’t look kindly on contractors who file liens they know are invalid.

Which Rights Do You Lose Forever vs. Rights You Still Have?

Understanding what’s gone versus what remains is essential for planning your next steps. Here’s the breakdown:

Rights You’ve Lost Forever:

- Property security interest: You can no longer claim a lien against the property itself.

- Foreclosure rights: No ability to force a sale of the property to collect your debt.

- Priority creditor status: You’re now equal to other unsecured creditors.

- Lien-based leverage: Property owners no longer face the threat of property encumbrance.

Rights You Still Retain:

- Contract rights: Your original contract remains enforceable through a lawsuit.

- Statutory payment protections: Texas Prompt Payment Act violations can still be pursued.

- Trust fund statute claims: If funds were improperly diverted, criminal and civil penalties apply.

- Collection rights: Standard debt collection methods remain available.

- Legal action: Breach of contract lawsuits are still possible.

The key difference is that all your remaining options require active legal pursuit rather than simply filing documents with the county clerk. Your Texas lien rights loss is permanent, but your contractual and statutory rights remain intact.

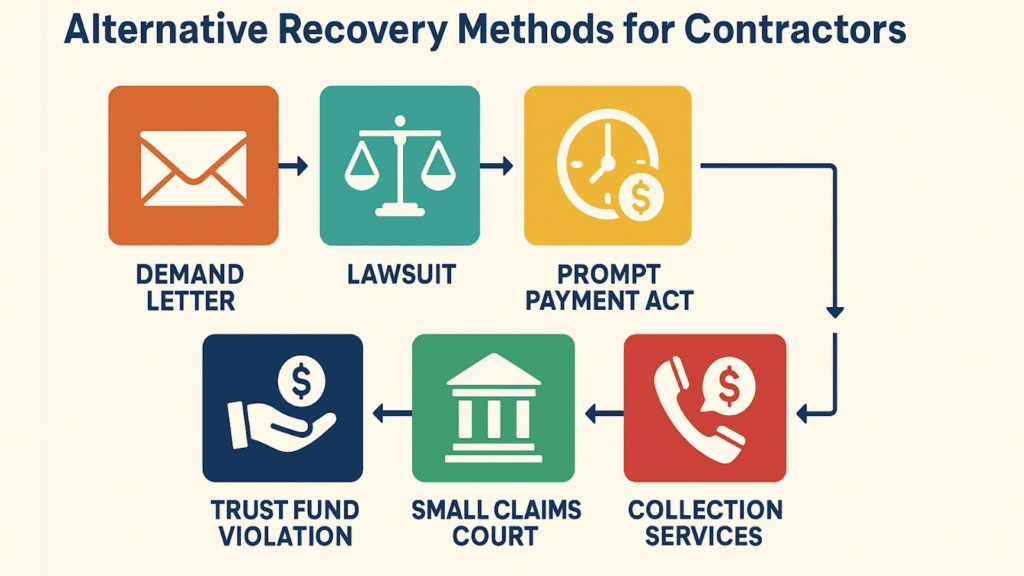

6 Alternative Recovery Options Still Available

Even after facing a missed lien deadline in Texas, several recovery paths remain open. Here are your primary alternatives:

1. Formal Demand Letters with Legal Backing

Start with a professionally crafted demand letter that references specific legal violations. Include potential claims under the Texas Prompt Payment Act, which allows for 18% annual interest on late payments. Reference the Trust Fund Statute if you suspect funds were diverted inappropriately.

2. Breach of Contract Lawsuits

Your original contract remains enforceable regardless of late lien filing. File a lawsuit for breach of contract, seeking not just the amount owed but also attorney fees, court costs, and any additional damages caused by the delayed payment.

3. Texas Prompt Payment Act Claims

If you weren’t paid within the statutory timeframes (typically 35 days for owners to contractors, 7 days for contractors to subcontractors), you can pursue interest penalties at 1.5% per month. This option creates significant financial pressure on non-paying parties.

4. Trust Fund Statute Violations

Texas Property Code Chapter 162 makes it illegal to divert construction funds for other purposes. If you can prove funds designated for your payment were used elsewhere, both civil and criminal penalties apply, including potential felony charges for the person who diverted funds.

5. Small Claims Court Actions

For debts under $20,000, Texas Justice Courts provide a streamlined process for collecting unpaid amounts. This option is faster and less expensive than district court litigation while still providing enforceable judgments.

6. Professional Collection Services

Legitimate collection agencies can pursue payment using methods unavailable to individual contractors. They often have more experience navigating debtor responses and can maintain pressure while you focus on current projects.

Which Recovery Steps Should You Take Immediately?

Time is critical when pursuing alternatives to lien rights. Here’s your immediate action plan:

Document Everything Now: Gather all contracts, invoices, payment records, correspondence, and proof of work completion. Create a timeline showing when work was performed, when invoices were sent, and when payments were due. This documentation forms the foundation of any legal action.

Calculate All Damages and Interest: Determine not just the principal amount owed but also accrued interest under the Prompt Payment Act, additional costs caused by delayed payment, and potential attorney fees. This gives you a complete picture of your total claim.

Send a Comprehensive Demand Letter: Draft a formal demand letter addressing multiple potential violations. Reference the original contract breach, potential Prompt Payment Act violations, and any Trust Fund Statute concerns. Include calculation of interest and attorney fees. Give a specific deadline for response, which is typically 10 to 14 days.

Evaluate Your Evidence: Assess the strength of your documentation and the likelihood of collection. Consider the debtor’s financial situation, available assets, and history of payment disputes. This analysis helps determine whether legal action is worth pursuing.

Consult Legal Counsel: Given the complexity of construction law and the various statutes involved, professional legal advice becomes crucial once lien rights are lost. Many construction attorneys offer consultations to evaluate case strength and potential recovery amounts.

When Does Legal Action Make Financial Sense?

Not every unpaid debt justifies the cost of legal action. Consider these factors when deciding whether to pursue formal collection:

Debt Size vs. Legal Costs: Generally, debts under $5,000 are better suited for small claims court, while larger amounts may justify hiring an attorney. Consider that attorney fees, court costs, and time investment can quickly add up.

Debtor’s Financial Condition: Research the paying party’s financial stability. If they’re facing bankruptcy or have no attachable assets, legal action may not produce results regardless of how strong your case is.

Strength of Documentation: Your chances of success depend heavily on having clear contracts, detailed invoices, proof of work completion, and documentation of payment demands. Weak documentation significantly reduces recovery likelihood.

Time and Resource Availability: Lawsuits require ongoing attention and can take months to resolve. Consider whether you have the time and mental energy to pursue legal action while maintaining your current business operations.

Contractors who act quickly after payment disputes typically achieve better recovery rates than those who wait months before taking action.

Understanding the Bigger Picture

A missed lien deadline in Texas is a learning opportunity that can prevent future problems. Many contractors discover that systematic deadline tracking, better contract terms, and proactive payment follow-up dramatically reduce collection issues.

Consider implementing project management systems that automatically track lien notice requirements and filing deadlines for all ongoing projects. Many contractors find that sending preliminary notices early, even when not strictly required, helps prevent payment problems from developing.

Review your contract terms to ensure they include clear payment schedules, interest provisions for late payments, and attorney fee clauses. These provisions strengthen your position in collection efforts and make legal action more economically viable.

The construction industry’s payment problems aren’t going away, but contractors who understand their legal rights and act decisively when problems arise typically achieve much better outcomes than those who hope problems will resolve themselves.

Frequently Asked Questions

Is there any way to file a late lien in Texas? No, Texas provides no mechanism for filing liens after deadlines have passed. There are no extensions, lien grace periods, or late filing options. Once the deadline passes, lien rights are permanently lost.

Can I still get paid if I missed the deadline? Yes, you retain several collection options, including breach of contract lawsuits, Prompt Payment Act claims, Trust Fund Statute violations, and standard collection methods. While these may be less powerful than lien rights, they can still result in payment.

What’s the difference between a lien and a lawsuit? A lien creates a security interest in the property itself, giving you priority over other creditors and the ability to force a foreclosure sale. A lawsuit only creates a judgment that must be collected through other means, putting you in competition with other unsecured creditors.

How long do I have to file a lawsuit instead? Breach of contract claims must typically be filed within four years of when the breach occurred. However, acting quickly is always better. Evidence becomes harder to gather, and witness memories fade over time.

Taking Control of Your Financial Future

Missing a lien deadline feels devastating, and honestly, it is a significant loss. Your strongest collection tool is gone, and getting paid just became much harder. But contractors who understand their remaining options and act decisively often still achieve positive outcomes.

The key is switching your mindset from “I lost my lien rights” to “I still have multiple legal remedies available.” Document everything, send formal demands, calculate all available damages, and don’t hesitate to pursue legal action when the numbers make sense.

Most importantly, use this experience to improve your future project management. Implement systems that track deadlines automatically, send notices early, and follow up on payments consistently. Prevention is always better than collection.

Ready to ensure this never happens again? Texas Easy Lien provides comprehensive lien management services that track deadlines, prepare documents, and help you stay on top of all requirements. Don’t let another deadline slip by. Contact us today to protect your future payment rights.